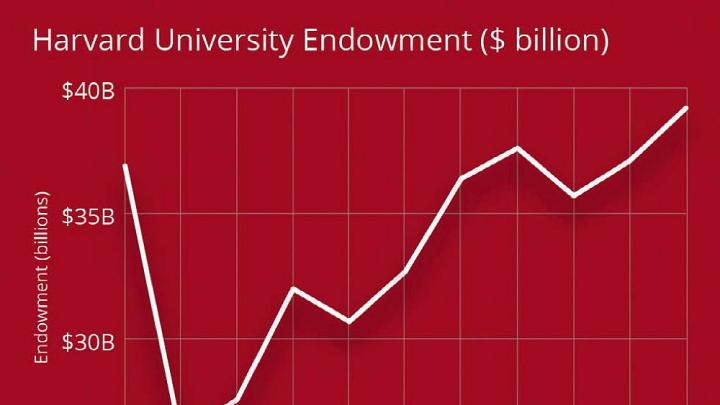

The investment return on Harvard’s endowment assets during the fiscal year ended June 30, 2018, was 10.0 percent and the endowment’s value on that date reached $39.2 billion—up 5.7 percent ($2.1 billion) from $37.1 billion a year earlier. N.P. Narvekar, CEO of Harvard Management Company (HMC), which manages the assets, announced the results on September 28. The net appreciation in the endowment reflects those investment gains, minus distributions from the endowment to fund Harvard’s academic operations (by far the University’s largest source of operating revenue), plus gifts added to the endowment (of which there have been plenty during The Harvard Campaign: see an update).

What Narvekar did not do was explain the results further. Reporting fiscal 2017 results last year—not long after he arrived with a mandate to overhaul HMC following years of investment returns below the University’s goal—he discussed restructuring of personnel and investment disciplines. But he did not provide any of the traditional details on the distribution of investments among different kinds of assets, returns by asset class, performance benchmarks, or long-term rates of return (see “‘Disappointing’ Endowment Returns—and a Protracted Restructuring,” November-December 2017, page 28). This year, he pared down even further; after a sentence detailing the fiscal 2018 endowment return and value, his entire statement concluded:

As is well known, HMC, as an organization, and the endowment portfolio are still in the early stages of a multi-year transition, with much work ahead. Thanks to the exceptional team we have at HMC, we are confident in the direction of the organization and the long-term prospects for the endowment.

For those interested, further details of our organizational progress and investment returns will be available in the University’s financial report, next month.

Accordingly, further insights, if any, into the status of the transition and how far along Narvekar and the HMC board think it has progressed await publication of Harvard’s annual financial report. Until then, it can be observed that:

- HMC’s results mean that for the first time in a decade, the nominal value of the endowment has for two years running exceeded the then-peak value of $36.9 billion recorded in fiscal 2008, just before the financial crisis caused catastrophic losses. (None of these figures are adjusted for inflation, which has reduced its real value by several billion dollars during that time.)

- In a year that was generally favorable for investors, with broad indexes of U.S. stocks up 12 percent to 14 percent, and international equities appreciating about half that much, HMC’s return exceeded the 8.1 percent it reported in fiscal 2017. It is unknown whether restructuring and severance costs recorded during that year, and losses taken on certain assets disposed of or designated for sale, depressed the reported return then.

The fiscal 2018 return matches the Wilshire Trust Universe Comparison Service’s median return for large (over $500 million) foundations and endowments. Among peer institutions whose endowment portfolios are HMC’s nearest cousins in size and asset mix, Princeton reported a 14.2 percent investment gain and 8.8 percent growth in the value of its endowment; Yale, 12.3 percent and 8.1 percent; and Stanford, 11.3 percent and 6.9 percent. These data, and other schools’ returns—MIT (13.5 percent), Notre Dame (12.2 percent), University of Virginia (11.4 percent)—suggest that HMC’s returns remain 2 to 3 percentage points lower than those earned by its closest peers: the institutions with which Harvard competes for professors and students. Applied to an asset pool the size of Harvard’s endowment, that margin translates into at least hundreds of millions of dollars less in investment gains for the University during the year. Hence the rationale for the changes Narvekar is making—and the importance, for the University’s long-term financial and academic health, of their success.

- The 5.7 percent rise in the endowment’s value in part reflects a relatively restrained rate of distributing funds to support Harvard’s operations. Following a decline in the endowment’s value in fiscal 2016, the Corporation directed that deans budget for flat distributions per unit of endowment their schools own during fiscal 2018. (It has also outlined a “collar,” within which distributions will rise: 2.5 percent per unit in the current fiscal year, and between 2.5 percent and 4.5 percent in fiscal 2020 and 2021.) During a time of change in Harvard’s leadership—and possibly its strategy and priorities—and against a backdrop of political and economic uncertainty and wholesale change within HMC, this fiscal path hedges against any hiccups in the portfolio, while helping to rebuild the endowment: an investment in the institution’s future spending power.

A detailed report appears at harvardmag.com/endowment-18. As soon as Harvard’s fiscal 2018 financial results are released, a full report will be published at www.harvardmagazine.com.