![]()

Main Menu ·

Search ·

Current Issue · Contact · Archives · Centennial · Letters to the Editor · FAQs

![]()

Main Menu ·

Search ·

Current Issue · Contact · Archives · Centennial · Letters to the Editor · FAQs

When all of the pennies are counted, that's how much Harvard's endowment will turn out to have been worth as of the end of the 1997 fiscal year, last June 30. That means the endowment has appreciated by nearly $4 billion since June 30, 1995. Although the University's annual financial report containing the exact figure will not appear until Thanksgiving, it is clear that Harvard Management Company (HMC) again harvested extraordinary investment returns.

In a September letter summarizing results, Jack R. Meyer, M.B.A. '69, president of the management company, reported that total investment return for the year was 25.8 percent. This figure--income and realized and unrealized gains on investments, after all expenses--nearly matched the 26 percent return achieved in fiscal 1996, a result Meyer characterized then as "exceptional." The consecutive extraordinary years--combining strong financial markets with stronger HMC performance--come just when a high level of capital contributions flowing from the University Campaign has boosted the volume of invested assets.

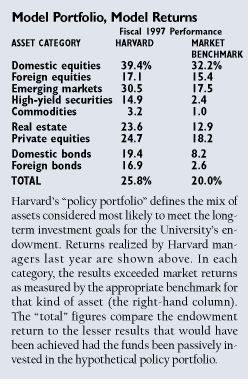

Beyond noting the obvious (1997 was "another exceptional year"), Meyer observed in an interview that for the first time since the present "policy portfolio" (see chart) was established in 1991, Harvard managers outperformed the market benchmarks in all nine asset categories. "Absolute performance was strong, but relative performance was outstanding," he said. "We outperformed, by a wide margin, at a time when most stock mutual fund managers, for example, had problems matching their benchmarks." Even without a repetition of the prior year's unusual results from commodities and private equities (such as venture capital), where Harvard earned 40-plus percent returns in 1996, Meyer called this year "remarkable" across the board.

How remarkable? HMC's results exceeded by 5.8 percentage points what the endowment would have earned had it been invested in funds designed to match the performance of the policy portfolio. That difference, the largest since HMC began investing this way, represents $550 million of additional endowment appreciation for the year. HMC also handily exceeded the median performance of a universe of large, diversified institutional investment funds; here the margin was 5.5 percentage points. Including these results, HMC's five-year total return climbed to an annualized 18.9 percent, at the very forefront among peer institutions.

Harvard has not had such robust investment results back-to-back since fiscal 1985 and 1986, when the endowment returns reached 26.8 percent and 31.3 percent, respectively. Thereafter, market returns declined, and Harvard's returns deteriorated even more; significant underperformance from 1989 through 1991 precipitated the new HMC management organization and investing disciplines.

Not one to tempt fate, Meyer ended his letter on a "cautionary note," warning that HMC's five-year rate of return is unlikely to be sustained, and that there will "certainly" be years when Harvard's investments underperform both the relevant market indexes and peer institutions. In what might be taken as friendly advice to University administrators and deans, individual investors, and M.B.A. candidates and undergraduate students now being wooed by investment-banking firms swarming over the campus, Meyer urged one and all not to be deluded "into thinking that double-digit returns will persist indefinitely."

Main Menu ·

Search · Current Issue · Contact · Archives · Centennial · Letters to the Editor · FAQs

![]()