The Trump administration’s successful efforts at tax legislation stand out as the primary achievement of its first year. But the hurried, largely furtive drafting, and rush to passage at the end of 2017, have helped obscure the new tax regime’s real impact. Much of the reporting and debate has focused on the politicking that went into passing the bill, and the purported effect on the federal budget deficit. That has diverted attention from the true significance of the Tax Cuts and Jobs Act (TCJA). Instead of simply changing rates and addressing loopholes, the TCJA represents a structural change to the income tax and, consequently, will lead to major changes in behavior. Teasing out those details reveals that the new law is likely to generate different incentives for economic growth than commonly claimed, unwanted complexities that invite still further gaming of the tax code (which the reforms themselves were intended to minimize), and larger deficits than forecast. If the past is a guide, and we can hope it is, the TCJA will be a precursor to further reforms that correct these shortcomings and address important distributional and fiscal concerns.

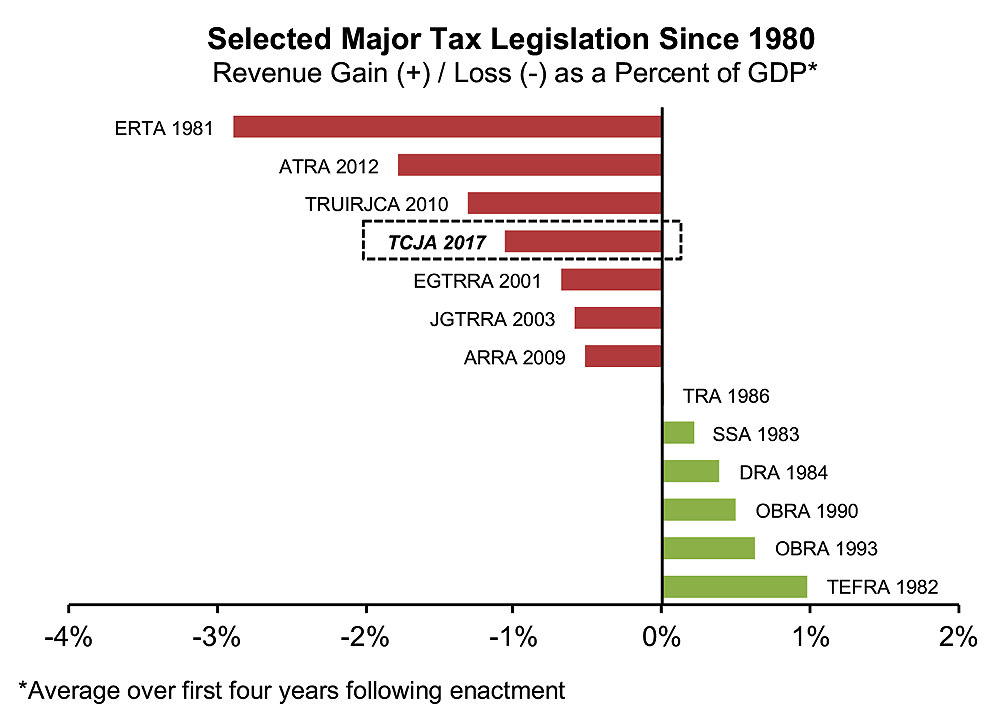

In the context of other legislation during the past 40 years, the magnitude of this tax reform is unremarkable when framed relative to gross domestic product. Indeed, the 1981 tax bill reduced federal revenue by an amount equaling more than twice the share of the estimated reduction in the Trump edition. But no reform during the last four decades approximates the scope and depth of the TCJA’s changes to the overall structure of the tax system.

Chart by Mihir A. Desai

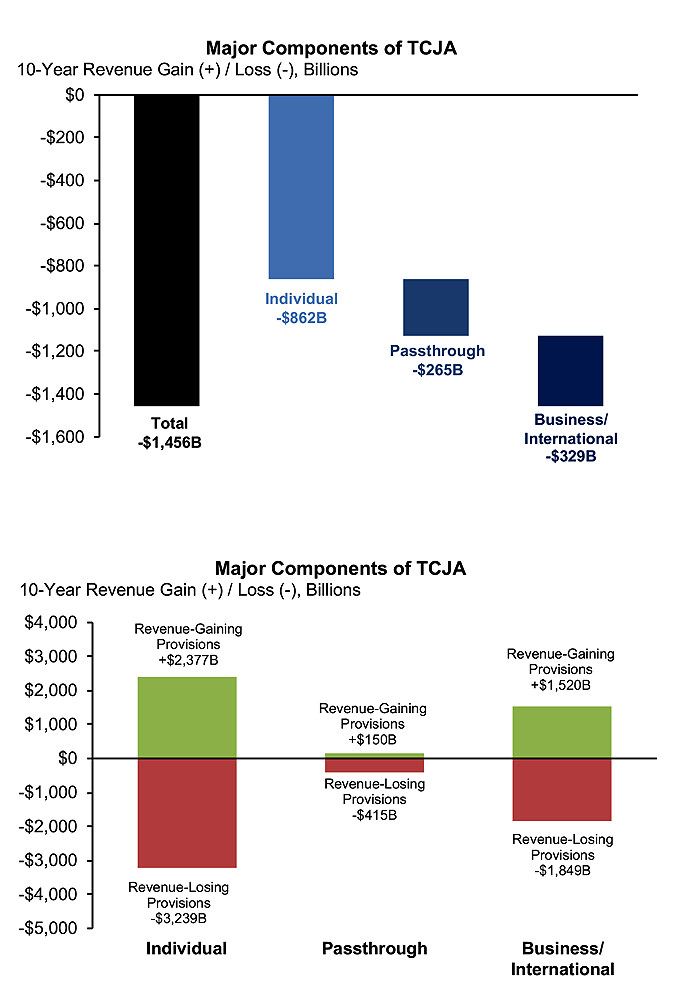

The unwieldy legislation is best understood by separately considering its impact on corporations, pass-through entities (businesses that are taxed not as entities, but rather at the individual or proprietor level, to whom income is “passed through”), and individuals. The congressional Joint Committee on Taxation has estimated the TCJA’s revenue cost to be $1.5 trillion over 10 years, distributed among individuals (60 percent), corporations (22 percent), and pass-throughs (18 percent).

These are net figures, reflecting tax cuts offset by tax increases. For example, for individuals, the legislation creates $3.2 trillion of cuts and $2.4 trillion of increases, resulting in a net revenue loss of $862 billion. The total revenue lost through the corporate provisions is $329 billion, representing $1.85 trillion of cuts and $1.52 trillion of increases. As such, the scope of the provisions is far larger than net numbers reveal, and there will be sizable numbers of winners and losers.

Charts by Mihir A. Desai

Revolutionizing the Corporate Tax: Domestic Effects

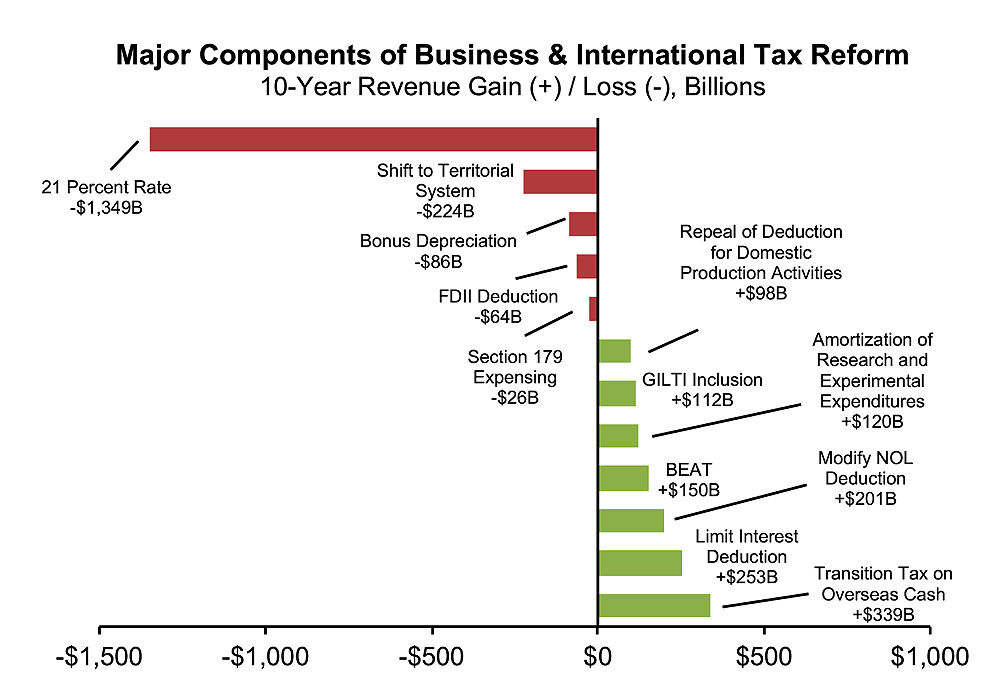

Any of the five major changes to the corporate tax code described below would constitute a significant reform if examined separately. Taken together, they constitute a revolution in the way corporations are taxed (see Figure 4)—a revolution that was long overdue. The corporate tax featured the worst of all worlds: a relatively high marginal rate that created incentives for companies to move income around the world through various techniques, and enough loopholes to allow for the average rates actually assessed to be considerably lower. The U.S. regime of taxing corporations’ international income, earned in other jurisdictions, was problematic because it was out of step with the practices of comparable countries around the world. These effects were visible in the tax-motivated efforts of U.S. corporations to move their headquarters abroad, and in the large piles of cash—most recently estimated to exceed $2.0 trillion—they held in offshore jurisdictions.

Chart by Mihir A. Desai

The first reform is to reduce the statutory corporate tax rate from 35 percent to 21 percent, a reduction that easily eclipses any undertaken by a developed country during the last several decades. The second is to liberalize the tax treatment of capital expenditures on equipment; previously, such investments were deducted over time according to depreciation schedules, but now they can be deducted entirely in the year they are undertaken (so-called expensing)—resulting in lower reported income, and therefore a lower tax bill, in the year of the expenditure. Third, rather than taxing corporations on their income realized around the world and then providing credits for taxes already paid abroad, the United States will now move to an emphasis on taxing only domestic profits (transitioning from a worldwide to a territorial regime). As part of that transition, the stockpiles of foreign profits, previously held abroad in order to defer tax obligations, will be taxed. A fourth set of reforms introduces three new international tax instruments that are completely novel on the global scene. Finally, the deductibility of interest at the corporate level will be limited to 30 percent of a corporation’s operating profit.

A major rationale for the corporate reforms is to incentivize corporate investment, prompting gains in productivity and, ultimately, greater wages for workers. How well will the TCJA perform? That turns out to depend on the interaction of the statutory-rate reduction, the implementation of full expensing, and the limits on interest deductibility. Far from being uniform, these features are likely to interact in surprising ways for different types of investments. In general, the rate reduction and the move from depreciation to expensing improve investment incentives, but the limitation on interest deductibility raises the cost of investment.

For investment in equipment—a key element in the productivity equation—expensing is the critical factor. In fact, expensing allows the tax rate on new investment to become irrelevant. Under expensing, the firm gets tax relief at the time of investment and then later gives up profits—meaning the government is effectively functioning as a joint-venture partner with an ownership level that corresponds to the tax rate. As such, the pretax and post-tax rates of return are the same, ensuring no distortion to investment decisions. This improves investment incentives, but only slightly: the government was already providing accelerations of depreciation that yielded some of the benefits of expensing. At the same time, the lower tax rate and limits on interest deductibility decrease investment incentives because they make debt financing less beneficial than before. Curiously, in fact, firms now will also have incentives to locate debt-financed investment abroad, where these limits on interest deductions don’t bite. Overall, investment incentives for equipment are improved, but not enormously because of these offsetting effects.

For structures and real property, with expected long lives and limited TCJA changes in depreciation, the reduction in the tax rate is critical—and those improved incentive effects from the new law are only partially offset by the limits on interest deductibility, so the incentive to invest in structures will increase significantly. Along with some of the changes to pass-through taxation described below, these changes amplify generous pre-existing benefits to the real-estate sector.

Finally, some investment incentives for intellectual property (research and development, patents) are actually reduced under the TCJA, because of the switch away from expensing toward amortization over time for these investments, plus the fact that a lower tax rate reduces the value of interest deductibility. Other changes (for example, limiting the use of net operating losses) are major deterrents to investment and offset these improved incentives across all investment types.

Taken together, these changes improve corporate investment incentives in the United States, but they vary by investment type and economic sector of the economy—contradicting the simple view that a rate reduction greatly helps investment. And, some fraction of these corporate-tax reductions will flow to workers, although the magnitude of that benefit has been considerably exaggerated. Indeed, the primary effect of the rate reduction alone is to provide a windfall to investments already in place that were undertaken with the expectation of a higher tax rate.

Taxing Corporations’ Overseas Activities

The more notable corporate changes relate to the taxation of overseas activities. First, taxing profits previously warehoused abroad will raise significant revenue—and the transition from a worldwide regime to a territorial one removes the perverse incentives to store future profits abroad. Combining those two changes will raise a serious challenge for corporations as they consider how to allocate their capital. When and how should cash be distributed to shareholders, or invested? If cash is to be distributed, are dividends or share buybacks preferred? If companies invest, do they prefer organic investment or mergers? The value creation (or destruction) associated with these decisions will ripple through the economy for the next decade and, given the sheer size of the stock of cash held overseas, may dominate the TCJA’s effects on the economy.

Going forward, the shift to territoriality and the reduction in the corporate tax rate will make the United States a more hospitable domicile for corporations, reducing their incentives to leave (or be acquired by a foreign company) and to transfer profits abroad through convoluted structures. So far, so good.

But as with so much surrounding the TCJA, that simple story is complicated—in this case, by three novel tax instruments that are embedded in the law. Each is motivated by the fear that a move to territoriality will provide incentives for firms to move profits out of the country to lower-tax jurisdictions, given that the United States now attempts only to tax profits within its borders. The already sizable operations and profits of multinational firms in low-tax countries, such as Ireland, may now grow considerably because firms would no longer face a U.S. tax on foreign profits.

First, a minimum tax attempts to ensure that corporations pay a minimum tax (effectively at 13.125 percent) on their profits abroad. This provision is meant to discourage moving profits to ultra-low-tax jurisdictions, as that income will still face a 13.125 percent rate at home. Unfortunately, this mechanism has several perverse effects. It strongly encourages governments around the world to change their rates to 13.125 percent, shifting all revenue from this tax to foreign governments. Indeed, this supposed floor on taxes paid around the world may well become a ceiling. Such a minimum tax will effectively vitiate the transition to a territorial system. In reality, the TCJA creates a new worldwide regime at a 13.125 percent rate without the historic advantages of deferral—undoing many of the benefits of moving to territoriality. The actual operation of the minimum tax also provides an incentive to move investment abroad—and its complexity and unresolved details have created havoc for multinational firms as they struggle to understand how it will actually work. One example of this complexity: firms will not benefit domestically from expensing fully because of this minimum tax abroad.

Second, in an effort to ensure that intellectual property is not moved abroad—a favorite tax strategy of various technology giants—the legislation provides a preferential rate (also 13.125 percent) on income from intellectual property domiciled domestically that is associated with exports. This provision aims to make the United States a more competitive location for intellectual property, an imperative created by the spread of preferential regimes for intellectual property called “patent boxes” around the world. Unfortunately, the emphasis on exports means this provision may not comply with international agreements. And again, its actual workings may make firms want to move real investment abroad in order to maximize the benefit of the provision.

In a final effort to curtail profit-shifting out of the United States, the new “base-erosion anti-avoidance tax” (BEAT) tax presumes that services transactions by multinational firms with related parties are motivated by tax-avoidance. Both the presumption of avoidance and the willingness to tax transactions rather than profits are novel, making this provision a signal challenge to current international norms and treaties, suggesting that it may not withstand scrutiny. While it remains on the books, it will create havoc in the global supply chains of multinational firms.

The Corporate Change in Context

In many ways, the corporate provisions are the best part of the TCJA: the shift to territoriality and the rate reduction were long overdue and had enjoyed bipartisan support. Unfortunately, that core of the corporate provisions was spoiled by several decisions. The desire to get the rate to 21 percent was enormously expensive, as every percentage point reduction represented a $100-billion cost over 10 years—and created a larger windfall to older investment. To offset that revenue loss, the tax treatment of research expenditures was made less generous, interest limitations were introduced, and a host of international taxes were created that undo the benefits of the shift to territorial taxation. A rate reduction to 25 percent and a simpler move to territoriality would have been preferable.

The actual legislation has created noteworthy winners and losers. As one example, multinational firms that employ intellectual property widely were previously able to pay global tax rates in the low teens or below; they now face a new world of tax complexity and potentially higher rates. In contrast, domestic firms that invest in real estate and have moderate debt will be clear winners.

Most ambitiously, the reform can be viewed as retreating from the idea of taxing income itself, given the mobility of income in a global setting with lots of intellectual property. The base for corporate taxation is becoming consumption rather than income: witness the preferential regime for exports, the denial of deductions for imported services from related parties, and the expensing of investment and limiting of interest deductibility—all of which move toward a cash-flow tax that gives up on taxing something as mobile as income in favor of taxing consumption. While other countries tax consumption via a value-added tax, we may be transitioning to a consumption tax effectuated through the corporate sector.

Who Am I?

The reduction in the corporate tax rate prompted so-called “small business” interests to advocate for comparable relief. These interests typically employ pass-through entities, so named because there is no taxation at the entity level (as with corporations); instead, all income is passed through to, and taxed at, the individual level. During the last 30 years, the share of business income that is associated with pass-through entities (partnerships, limited-liability corporations, and Subchapter S corporations) rose from less than 20 percent to more than 50 percent.

The 2017 legislation creates a new regime for pass-through entities by granting them a 20 percent reduction in their tax rate: an individual facing the new top 37 percent rate on labor income, for example, will now face a 29.6 percent tax rate on pass-through income. This new regime for pass-through income creates a host of tax-planning opportunities of mind-numbing complexity. For the first time since the tax reforms of the early 1980s, individuals will have to confront existential tax questions: Who am I? Do I want to be a corporation, a pass-through entity, or just an individual?

The legislation creates a large gap between corporate tax rates and top personal marginal rates, a gap not present in the tax code during the last 40 years. Such a gap can make a corporation a tax shelter for individuals who want to avail themselves of the lower 21 percent rate. As an example, an individual could corporatize and provide consulting services to clients and pay herself only a small amount of that income. Wealth saved in the corporation could also grow and pay that lower tax rate. (This opportunity is limited in two ways. First, there are accumulated-earnings and personal-holding-company taxes designed to deter such opportunism, but they have not been used widely and pose significant implementation issues. The bigger limitation is that distributing the cash from the corporation will incur additional taxation as it is delivered to the individual. Absent reaching tax nirvana—the ability to exempt historic returns from taxation by dying (the step-up basis for inherited assets)—the combination of corporate and individual tax can make this strategy less desirable.)

The TCJA’s new pass-through regime will also provide an incentive for some corporations and individuals to become pass-through entities. Corporations that don’t want to pay both the corporate tax and shareholder-level taxes can avail themselves of one level of taxation by becoming pass-through entities.

Similarly, individuals who would rather pay at a 29.6 percent rather than a 37 percent rate can stop being employees and contract with their employers as pass-through entities. Indeed, it may become commonplace for similarly situated workers to find that they are paying very different taxes because some are pass-through entities and others are employees. (Taking advantage of these provisions is easiest for families earning less than $315,000. Higher-income earners will need to be more savvy about this, as many engaged in “services” activities will not be allowed to take advantage of this provision easily. What is a service? The legislation ensures that some services are specifically identified but leaves much more to be articulated. At a minimum, one can imagine that firms that are service providers might find it advisable to split into separate services and technology branches so that part of the firm can avail itself of the advantageous rate.)

Taken together, the TCJA’s pass-through provisions are enormously complex, create numerous tax-planning opportunities, and will create windfalls to those best positioned to navigate that complexity. As such, they represent some of the worst parts of the legislation—and will likely cost the federal government far more revenue than projected, given the myriad behavioral responses to this new regime. The pass-through regime was designed to limit the incentive to corporatize by reducing the relevant gap from 16 percentage points (37 percent versus 21 percent) to 8.6 percentage points (29.6 percent versus 21 percent). It would have been wiser to police the corporatization margin more effectively, rather than create an entirely new regime with its own difficulties.

Individual Taxes: Simplification and Redistribution

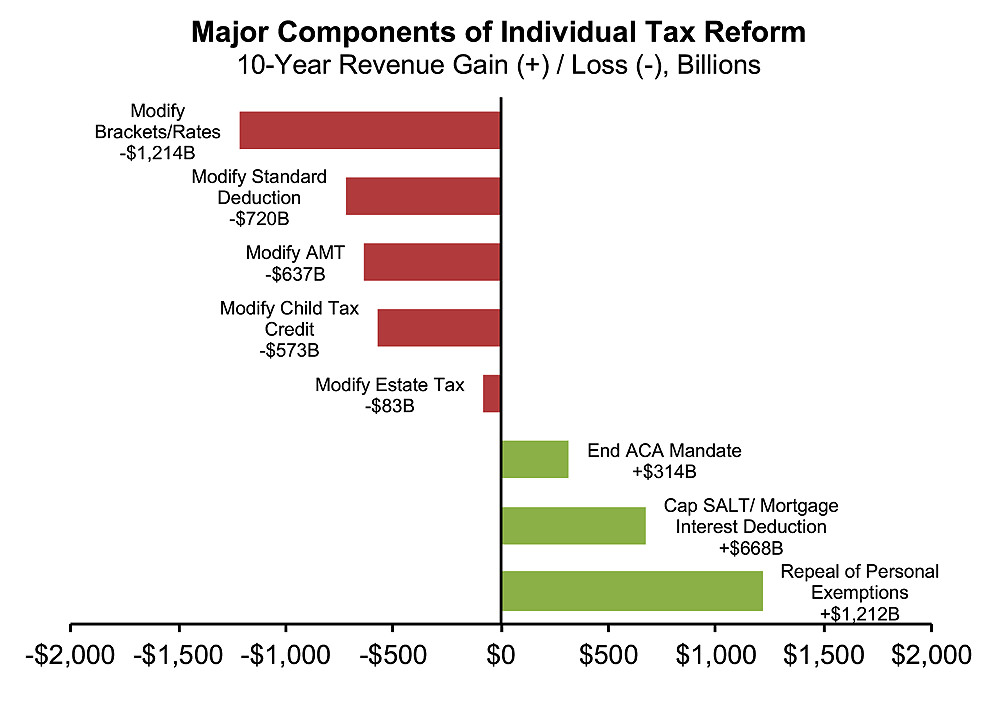

At the individual level, the changes are somewhat less structural. New brackets and lower rates are typical in “reforms,” and this one lowers the top marginal tax rate from 39.6 percent to 37 percent and raises the income level at which this top bracket begins.

The structural change occurs in the way zero-tax brackets—ranges of income where no income tax is due—are accomplished. Historically, personal exemptions and a standard deduction combined to create a zero bracket. Now, exemptions are gone; the standard deduction has increased considerably; and an expanded, more refundable child credit has been created. Overall, the changes to exemptions, child credits, and standard deductions add up roughly to a zero effect on tax revenue; they are structural changes that help simplify the individual code by enabling more people to avoid itemizing. The increased refundability of the child credit, along with the phase-out of the credits for higher-income taxpayers, mean that these changes are moderately progressive.

Chart by Mihir A. Desai

The other notable changes limit the deductibility of state and local taxes to $10,000 and reduce the limit on interest-deductibility on mortgages and home-equity loans from $1.1 million to mortgages alone of $750,000. These changes adversely affect higher-income individuals and, notably, individuals in high-income-tax states with high property values. Although these provisions can be viewed as targeting coastal Democratic states, it’s also the case that those individuals are the cohort most likely affected by the Alternative Minimum Tax; its bite is lessened under the TCJA. Taken together, these changes should amplify the incentives for high-income individuals to relocate from high-income-tax states; absent some remedies, they will also create fiscal pressure on state governments.

The context of this sweeping overhaul has eclipsed the importance of otherwise important reforms. In particular, a variety of miscellaneous business deductions have been limited, the scope of the estate tax was reduced considerably, and the tax penalty that underpinned the mandate of the Affordable Care Act was repealed. Each of these provisions will have major impacts on the self-employed, the estate-planning industry, and the healthcare market.

In economic terms, the most significant individual-tax changes are the new rates and brackets. Collectively, they are large tax reductions and, unsurprisingly, largely accrue to the largest tax payers: high-income individuals. But the share of all taxes paid across the income spectrum is distributed similarly before and after the tax reform.

One key difference is that most individual tax changes are phased out over time; the TCJA’s corporate changes are permanent. Because corporate tax changes are thought to accrue mostly to higher-income taxpayers, the long-run effects are regressive: they appear to shift a greater share of taxes paid to lower-income individuals after the individual changes are phased out. Of course, it is not clear that the individual tax cuts will be allowed to phase out, nor is it completely true that corporate tax changes don’t benefit workers across the income spectrum.

The Challenge to Universities

During the last decade, several ideas that take aim at the tax-exempt status of universities have percolated through legislative hearings. Two of them came to fruition as part of the recent legislation. First, a 1.4 percent tax on the returns of large endowments has been enacted; it is forecast to raise $1.8 billion for the federal government over 10 years. Harvard has suggested that its annual taxes due will be greater than $40 million, an estimate that corresponds to the University’s contributing more than 20 percent of the revenue raised by this provision (see “Endowments, Taxed,” March-April, page 18). Second, $3.8 billion will be raised by prohibiting universities from offsetting the profits and losses of their unrelated businesses (hotels and conference centers, for example), making more of their income subject to taxation.

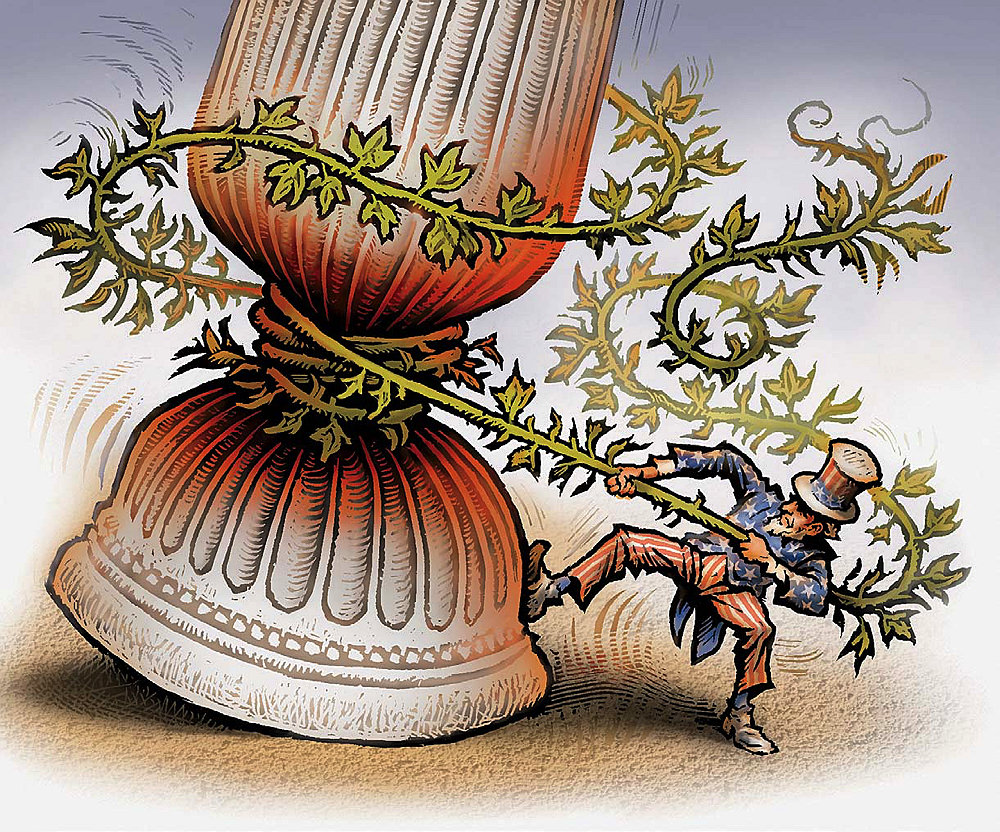

Illustration by Phil Foster

These efforts are notable for three reasons. First, although they are relatively small in the scope of the overall legislation, they should be understood as the first step in a continuing effort to challenge the tax-exempt status of elite universities. Second, they are quite targeted: the endowment tax will apply to fewer than 50 institutions, with the vast majority of tax revenue coming from a handful of universities. Along with the limitations on the deductions of individuals, these steps represent the “weaponization” of the tax code—a particularly problematic development. Finally, they go to the core of universities’ tax-exempt status. Taken together, these efforts represent the culmination, for now, of long-simmering doubts about the degree to which elite institutions are conducting themselves in a manner consistent with the expectations created by tax-exempt status.

Missed Opportunities…and What’s Next?

The core of the TCJA is a long overdue modernization of the corporate tax. The desire to reduce the rate below 25 percent, and Congress’s inability to pass a pure corporate tax reform, required additional changes, including new international taxes that undo some of the benefits of those core improvements. Changes in pass-through taxation have added remarkable complexity and scope for gaming the tax system, with few associated benefits. Finally, in pursuit of a headline trumpeting middle-class tax cuts, individual changes were included that dramatically increased the fiscal cost of the legislation.

That stated fiscal cost of $1.5 trillion is likely severely understated because it envisions future reversals of tax cuts that, once granted, are in fact hard to reverse. The complex international and pass-through provisions open the door to tax-reducing strategies that we can only begin to imagine. And that fiscal cost, in the context of current federal-budget deficit realities and an economy near or at full employment, will likely be associated with interest-rate increases that partially undo the economic benefits associated with the law’s improved investment incentives.

The most noteworthy missed opportunities in this legislation relate to the inability to make the individual tax considerably more progressive to address current appetites for redistribution. Specifically, a large increase in the earned-income tax credit (EITC) for the lowest-income Americans could be financed by a new top bracket and a repeal of the step-up basis for inherited assets. The EITC provides good work incentives but is currently undersized and an expansion enjoys bipartisan support. Additionally, the population in the top bracket has grown to capture 1.0 percent of taxpayers; historically the top bracket captured 0.1 percent of taxpayers. The growth of the population in the top bracket is problematic, because very different taxpayers are being treated similarly and because such a populous top bracket makes raising the rate on the very wealthy difficult. Creating a new top bracket for taxpayers with income above $2 million, associated with a higher tax rate, on the other hand, could help finance an expansion of the EITC, as suggested above. And the step-up basis for inherited assets continues to benefit the wealthiest and provides incentives to hold on to assets all too long—reasons this benefit for the most privileged Americans might productively be subjected to taxation. More ambitiously, the relatively broad support for carbon taxes remains an untapped opportunity.

What comes next? We should expect a significant response from other nations in the form of challenges and policy moves in reaction to the TCJA provisions that have tenuous underpinnings under international agreements and treaties. These legal challenges may be particularly problematic at a time when the U.S. government seems eager to turn its back on international treaties and norms. The consequential moves by the United States to slash the statutory corporate tax rate and try to enact a minimum worldwide tax rate will narrow the corridor of desirable tax rates for other countries to between 13 percent and 21 percent—a dynamic that could lessen the tax competition that was present under the previous regime, in which corporations sought ever-lower tax rates with their overseas income.

Domestically, the TCJA is most reminiscent of the 1981 tax cuts. That legislation was followed by a 1982 reform that reversed some of its effects, and additional annual reforms that further patched and improved the initial act. Ultimately, these more minor fixes prompted the transformational reform of 1986—a genuinely comprehensive simplification and rationalization of the tax code.

If the next five years follow suit, the TCJA will have accomplished much by beginning that process. Of course, skeptics will quickly point to the differing political dynamics between and within parties today relative to the 1980s—and to the resulting general inability to pass any meaningful legislation. But those same skeptics, including me, would have argued that the TCJA would never have passed in the first place. Given current fiscal realities, we should all hope that the TCJA represents the beginning of tax reform, rather the end.