Traditionally, the best tickets put you nearest the action, but here in the skybox, we look down, as if from an aerie, on the baseball game below. Yet these are easily the most expensive seats in the house. This condo-in-a-stadium costs $250,000, and that's without tickets; our Fortune 500 host must purchase at least 10 of those to every single event held here. The skybox is an office environment, suitable for a business meeting, with phones, faxes, data lines, a refrigerator, sinks, a bathroom. We can have food served, although the $50 tariff for a mediocre plate of nachos does seem a tad steep--or would, if anyone were paying personally. And let's pull out those Zeiss binoculars: the ball game is awfully distant. Luckily, if the action seems too remote or becomes tedious, there are a few television sets. Maybe we can catch some financial news.

Few ever venture here; the pricey seats often remain vacant during games. Even so, in its way, the skybox distills the essence of professional sports today. Lavish expense, new stadiums with cushy amenities, live entertainment performed at a distance, competing electronic media, and above all, the corporate takeover of professional sports--the themes are all here. Yet this sky may fall; the torrential flow of cash into sports, some contend, has degraded the athletic enterprise--even for those privileged spectators at the top. "It can be an antiseptic experience to sit in the skybox," says Gil Kerr '75, vice president of broadcasting and programming for the Professional Golfers Association (PGA). Kerr spent a decade in a similar role for the National Basketball Association (NBA), where he sometimes sat in skyboxes. "There, it's a business and hospitality clientele, not really an excited fan base," he says.

|

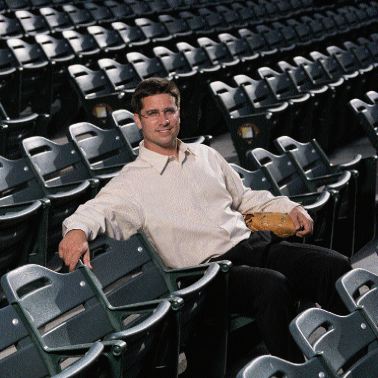

| From mounds and rubbers to round numbers: Jeff Musselman '85 relaxes in Anaheim Stadium, home of the Anaheim Angels. Once a pitcher with the Toronto Blue Jays and New York Mets, he now represents baseball players as an athletes' agent. |

| Photograph by Robert Holley |

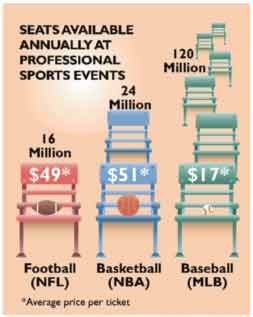

Along with the U.S. population, that fan base has grown enormously in the last half century, as new professional leagues sprouted, media mushroomed, and professional sports became thoroughly assimilated into the entertainment industry. Fans are the geese who have laid the golden eggs for pro athletes, team owners, sports broadcasters. Meanwhile, that same flow of cash has altered the relationship between spectators and the contests. A newfound distance, which can verge on alienation, separates the audience from athletes and teams. Choices made within the sports and political establishments over the next few years may determine whether pro sports' dizzy growth continues, or if those golden orbs will turn into goose eggs.

Although Crimson athletes have played professionally in various sports (including football, baseball, basketball, hockey, soccer, tennis, and squash), no one thinks of the Yard as a launching pad for top jocks. But Harvard does have a long tradition of educating business leaders, and as pro sports has evolved into a major industry, Harvard alumni and faculty members have taken pivotal roles--broadcasting games, representing athletes, managing leagues, analyzing economic and legal issues that shape sports. Below, a few of them offer their perspectives on the field of grass, watered by money.

Skyrocketing Sums

In 1950, one professional sport--major league baseball--was dominant in America. Professional football, basketball, and hockey were, by comparison, niche businesses. Radio carried baseball games, television did not. The American and National Leagues each had eight baseball teams, so most fans could view only minor league or college games. There were no "playoffs": the two regular-season league champions met directly in the World Series.

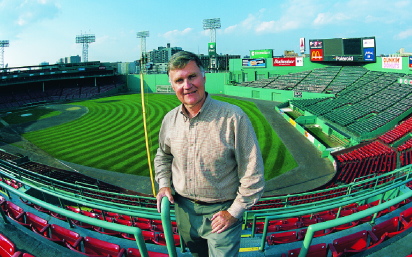

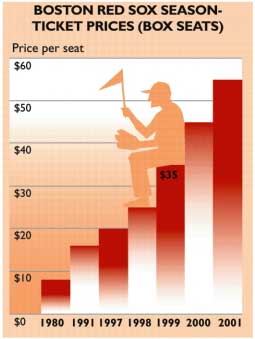

Everything changed when television began airing sports in the 1950s, creating a vast audience of spectators who were not at the park or the arena. The sale of broadcast rights funneled new revenue streams into all sports that made it onto the airwaves, and those revenues have since expanded enormously, upending the industry's economics. "Now there is so much riding on the sport and the individual franchises," says Friendly professor of law Paul Weiler. A specialist in sports and entertainment law, Weiler is also a major sports fan who has held Boston Red Sox season tickets for more than two decades.

|

| Sports-law specialist and Harvard Law School professor Paul Weiler at Fenway Park. As a Boston Red Sox season-ticket holder, his outlays to watch the games there have risen steeply in recent years (see graph, opposite). |

Photograph by Rick Friedman |

In Leveling the Playing Field: How the Law Can Make Sports Better for Fans (Harvard University Press, 2000), Weiler analyzes several of professional sports' growing pains. He notes that the expansion of the pro-sports sector has far outstripped the rest of the American economy. In 1960, for example, the Dow Jones Industrial Average was around 500; today it has increased 20-fold to more than 10,000. That's a hefty gain, but compare it to the rocket-like trajectory of pro football. In 1962, the National Football League (NFL) saw its annual television revenues reach $3 million; in 1998, the comparable figure was $2.2 billion, more than a 700-fold increase. Team values have spiked even more dramatically. In 1960, the Dallas Cowboys NFL expansion franchise cost $600,000 to create. By 1998, the Houston Oilers sold for $700 million, and the Cowboys were valued at about $1 billion--nearly 1,700 times the original investment. "The stock market's growth has just been dwarfed by sports," says Weiler. The financial explosion has changed virtually every aspect of pro sports, from player salaries to new stadiums to the enhanced political clout of owners and leagues.

Propelling that growth, "There's been an exponential increase in the media coverage of sports--both the number of events televised and the number of media involved," says Ed Durso '75, executive vice president for administration at ESPN, the sports cable-TV network. "Twenty years ago, cable TV was not a factor, satellite TV did not exist. Now there are 10 million satellite dishes. You can purchase packages to watch every game in every sport. With the increased popularity, the values of broadcast rights have gone up tremendously," as pay-TV revenues join the advertising-supported network programs.

The growth of women's sports has also opened new professional markets. The WNBA, a women's pro-basketball league launched by the NBA, began play in the summer of 1997. Three TV networks carried their games to 50 million viewers that season. By 1999, WNBA games were broadcast in 125 countries, where viewers could watch players like Allison Feaster '98 compete for the Charlotte Sting. This spring, an eight-team women's professional soccer league, WUSA, started up with two former Crimson stars, Emily Stauffer '98 and Beth Zotter '00, on the New York Power roster.

The stunning flow of money into sports has reconfigured the ownership of teams. Corporations--especially beer brewers like Jacob Rupert (New York Yankees), Anheuser-Busch (St. Louis Cardinals), or Molson (Montreal Canadiens)--have long owned franchises. But half a century ago, professional teams were often a quasi-recreational pastime for affluent owners like Tom Yawkey of the Boston Red Sox or Wellington Mara, whose father, Tim, bought the New York Football Giants for $500 in 1925. These owners wanted to make money, but a team's profitability was often of secondary importance. Now, as the financial outlays required to buy and run teams have gone through the roof, "You need a Rupert Murdoch or a Disney to own a franchise," says Weiler. "And they really have to see themselves as making money out of it. To be on TV after winning the World Series or Super Bowl is icing on the cake--but the cake is the cash."

Soaring valuations have also made it difficult for families to keep control of teams. "The estate taxes became ridiculous--the old-style owners' families couldn't afford to keep the teams," explains Gary Woolf '87, who himself inherited and for several years operated Bob Woolf Associates, the athletes' agency that his father, ur-sports agent Bob Woolf, began in 1963.

"It used to be 'The Owner,'" says Dan Jiggetts '76, who was a 6-foot, 5-inch, 270-pound all-American offensive tackle at Harvard and the Crimson's first (and so far, only) African-American football captain. Jiggetts' nine-year pro career included seven seasons (1976-83) with the Chicago Bears, where he blocked for the great Walter Payton and played for a legendary owner, George Halas, founder of the National Football League. In 1985, Jiggetts moved to the broadcast booth; he now covers football, basketball, and even synchronized swimming for CBS radio and Fox television, and hosts a sports talk show on WSCR radio in Chicago. "With ownership by public corporations there's a different twist," he says. "They certainly bring marketing expertise, but you can also have situations where the owners become so anonymous that the players and the fans don't know who to talk to. Or to blame!"

"It used to be 'The Owner,'" says Dan Jiggetts '76, who was a 6-foot, 5-inch, 270-pound all-American offensive tackle at Harvard and the Crimson's first (and so far, only) African-American football captain. Jiggetts' nine-year pro career included seven seasons (1976-83) with the Chicago Bears, where he blocked for the great Walter Payton and played for a legendary owner, George Halas, founder of the National Football League. In 1985, Jiggetts moved to the broadcast booth; he now covers football, basketball, and even synchronized swimming for CBS radio and Fox television, and hosts a sports talk show on WSCR radio in Chicago. "With ownership by public corporations there's a different twist," he says. "They certainly bring marketing expertise, but you can also have situations where the owners become so anonymous that the players and the fans don't know who to talk to. Or to blame!"

Jeff Musselman '85 agrees. "Dealing with large organizations can get complicated," he says. "Some players in baseball don't know who the owner actually is." A left-hander, Musselman pitched for the Toronto Blue Jays and New York Mets from 1986 to 1990. In 1992 he joined the Scott Boras Corporation in Newport Beach, California, as a sports agent. Last year, he worked on the celebrated $252-million contract for Texas Rangers shortstop Alex Rodriguez, the biggest athlete's payday in baseball history and a sum exceeding the price paid for the Rangers franchise. The Rangers' owner, multibillionaire Tom Hicks, "has been able to bring a personal touch to ownership," says Musselman, crediting this fact with a role in expediting the Rodriguez negotiation.

But even vast financial resources may no longer be enough to stay competitive. Since the viewing audience has become so integral to the revenue stream, owners who control broadcasting networks have extra leverage. "What we have been experiencing in the last decade is entertainment conglomeration--including sports," says Weiler. "For example, [News Corp. chair Rupert] Murdoch had this big satellite TV network he wanted to use. By buying the Los Angeles Dodgers for Fox, he acquired rights to games he could put up in the sky." Other media behemoths, like Disney (Anaheim Angels, Mighty Ducks), or AOL Time Warner (Atlanta Braves and Hawks), have similar integration. Former Braves owner Ted Turner brilliantly leveraged his ownership of both a team and television outlets; by "narrowcasting" Braves games on his cable TV network, he turned his Atlanta television station, WTBS, into the country's first "superstation"--a local outlet with national reach.

Media that control sports events sometimes tinker with the contest to enhance advertising revenue rather than athletic performance. The "television time-out," charged to neither team since it is taken by the broadcaster, has long been common in football. Or consider the U.S. Open tennis tournament, which generates most of the annual revenue of the United States Tennis Association through its contract with CBS. Unlike the other three "grand slam" tennis tournaments, the U.S. Open schedules its semifinal and final matches on consecutive days, with no intervening rest day. This allows CBS to air these last big matches on Saturday and Sunday, maximizing viewership--and revenue. Several years ago, this arrangement led sportswriter Frank Deford to dub the tournament the "CBS U.S. Open."

Sports attract viewers into the tent where beer, cars, stock brokerage, and other goods and services are for sale. "Males aged 18 to 50 are a strong demographic group that advertisers want to reach," says Gary Woolf. "You can reach them through sports." Advertising and promotion now infiltrate both the names of the events and the venues--like the San Francisco Giants' new Pac Bell Park--where they occur.

The Cleveland-based firm IMG, where Peter Carfagna '75, J.D. '79, a former defensive back on the Harvard football team, is chief legal officer and general counsel, pioneered the field of sports marketing, which ties athletic events to corporate promotion. The sale of "naming rights" has become ubiquitous, Carfagna says: "There's the Nokia Sugar Bowl and the FedEx Orange Bowl. There's not one major bowl game without a title and presenting sponsor. You don't see a new stadium being built without a title. You can sell the scoreboards to Pepsi or Coke, and have a sponsor present the 'play of the game.' My kids and I joke that some day, baseball announcers will be saying, 'The next pitch will be brought to you by...'"

Sports as drawing cards serve the relentless corporate search for human attention. "It's about sticky eyeballs--where can we make them stick?" Carfagna says. Fox Sports announcer James Brown '73, who starred in basketball for Harvard and has been broadcasting sports for two decades, says, "Yes, there is an awful lot more entertainment, but I don't see it as a problem. Kids are growing up with MTV and video games. It's a natural thing for them to want pizzazz, a way to liven it up."

|

| On the set of Fox NFL Sunday: James Brown '73 ("JB") at left, with colleagues (left to right) Terry Bradshaw, Troy Aikman, Howie Long, and Cris Collinsworth. |

Photograph by Anita Bartlett |

Cynthia Austrian Weber '88, M.B.A. '93, who works for the NFL in corporate sponsorship and strategic planning, says, "There are more options out there competing for a share of the fans' minds, so sports have turned toward increasing their entertainment value to become a sports product and an entertainment product. Sports is entertainment--no one is trying to separate them."

The PGA's Gil Kerr asserts that basketball was "the first professional league to aggressively market sports as entertainment." During his 10 years with the NBA, he was supervising producer for two series of 30-second promotional campaigns: "NBA action--it's FANtastic!" and "I Love This Game." The latter won two Emmy awards. The spots compared basketball directly with high art, intercutting fast breaks and slam dunks with leaps by the Kirov Ballet, and using a Placido Domingo opera soundtrack under a slow-motion montage of artful passes and shots. "Barbra Streisand gets $10 million to $15 million for one concert," says Carfagna. Then, half-joking, he muses, "Maybe [New York Yankees shortstop Derek] Jeter is underpaid. Athletes are entertainers who perform live every night--the baseball season is 162 games long!"

The Uniform with Deep Pockets

Indeed, star athletes now command the financial rewards of star entertainers, which is what they are. The emergence of new leagues, the ascendance of players' unions, free agency, salary arbitration, athletes' agents, and the overall exploding revenues have pushed the compensation of athletes, especially the few stars, to unprecedented heights. In 1956, the players' share of total baseball revenue was less than 13 percent, but "player payrolls topped 60 percent of the $2.7 billion in league revenues in 1999, and the players' shares in other major sports were in roughly the same range," writes Paul Weiler. He adds that by the end of the 1990s, the average major-league pro athlete earned more than $1.4 million per year--35 times the 1974 average of $41,000. Opinion polls indicate that three-quarters of Americans think athletes are overpaid; perhaps one reason is that after inflation, athletes' real salaries rose tenfold over the last quarter century, while the median real hourly earnings of the average American worker went down by about 5 percent.

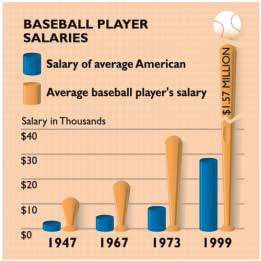

This increasing disparity in wages widens the social distance between fans and players. In 1947 the average baseball player earned $11,000 per year, a little over four times the average worker's pay. By 1999 that figure zoomed to $1.57 million, while the average worker (who now must pay more to watch the sports stars play) earned $28,000--a ratio of 56 to one (see graph below). Nevertheless, 50 years ago, fans could more readily identify with their athletic heroes; today, the players on the field and the fans in the stands reside in utterly different neighborhoods. Still, this hasn't yet deterred the spectators: the Atlanta Braves and San Francisco Giants, for example, today draw roughly six times the attendance they did in 1976, when free agency came to baseball.

|

| Chart by Stephen Anderson |

Labor lawyer and athletes' agent Richard Moss, LL.B. '55, who as general counsel to the players' union represented Los Angeles Dodgers pitcher Andy Messersmith in the 1975 case that created free agency in baseball, has since represented hundreds of baseball players in negotiations. He explains that, "from the player's point of view, it's not a question of money anymore, it's a question of status. You don't need $20 million a year to live well, you can be perfectly content with $3 million or $4 million. But when some other guy is making $20 million, and you think you're a better player than he is, then you want to get more than $20 million, to reflect your status."

Labor lawyer and athletes' agent Richard Moss, LL.B. '55, who as general counsel to the players' union represented Los Angeles Dodgers pitcher Andy Messersmith in the 1975 case that created free agency in baseball, has since represented hundreds of baseball players in negotiations. He explains that, "from the player's point of view, it's not a question of money anymore, it's a question of status. You don't need $20 million a year to live well, you can be perfectly content with $3 million or $4 million. But when some other guy is making $20 million, and you think you're a better player than he is, then you want to get more than $20 million, to reflect your status."

Taking a broader view on salaries, Musselman asks, "Does an athlete have greater social importance than a great teacher? I come from a teacher's family, and I've seen my dad do greater things than any baseball player. But the percentage of people who play major-league sports is tiny. This type of talent is a very rare commodity."

The sports-marketing company IMG has a strong presence in individual sports like tennis and golf. (Founder Mark McCormack launched his empire as agent for the charismatic golfer Arnold Palmer.) Individual stars like IMG clients Pete Sampras and Tiger Woods can multiply their tournament winnings several times with money from endorsements. "The proliferation of media gives these people incredible endorsement opportunities," says Peter Carfagna. "They can sell 'service days'--days when they are available to film commercials, make personal appearances, or whatever--in several categories: clothing, clubs or racquets, fast food, financial services." Such corporate contracts influence media coverage and sports journalism. "When I first got into the broadcasting business in the mid 1980s," says Dan Jiggetts, "athletes were mostly portrayed and packaged by TV and radio. Now it's more Madison Avenue. The packaging and imaging come from Nike, Reebok, or Adidas."

|

| Chart by Stephen Anderson |

The celebration of star athletes has a long history, especially in individual sports. Team sports, too, have always had standout performers, but the gush of sports money has created a financial scoreboard off the field that affects the way games are played on it. In an intensely team-oriented sport like basketball, for example, contracts driven by individual performance statistics--points, rebounds, assists--will tend to promote a style of play that feeds such numbers.

This may explain, in part, why fans seem to be dropping away from the NBA. There are empty seats all over the league now. The Charlotte Hornets, whose arena seats 23,000, may sell only 16,000 tickets to a home game. Kerr, who played basketball in high school and for the Harvard Classics, a club team, says that he was "always a huge basketball fan. But near the end of my 10 years with the NBA, I wasn't thrilled with where the sport was going. At the end of Michael Jordan's career, somebody pointed out that you never, ever saw Michael quit. You can't recall a game when he got tired and gave up--he always gave everything he had. Today, young players have lost sight of the game. They're not playing for the love of basketball so much as for the money. It's all about flash, razzle-dazzle, dunking the ball, one-on-one isolations, making the highlight film on ESPN. Teamwork, passing, the fundamentals, are being lost. People seem surprised by the NBA's decline, but I'm not. Michael Jordan was so good that he obscured some of the fundamental issues; when he left, they were exposed."

"There's a contradictory message sent," Fox's James Brown explains. "On one hand you have a head coach preaching the concept of team play. But on the business side, you're rewarded for individual stats. Sure, if Shaquille O'Neal scores lots of points, that will help the Lakers win games. But coaches today could learn a lot from [former Boston Celtics coach] Red Auerbach. Red was a master at keeping statistics concerned with helping the team as a whole. K.C. Jones was not a big scorer, but he was a tremendous defensive player, and you could measure that in steals, deflected passes, disrupted plays."

Franchise Free Agency

Many fans believe that baseball players have become more mobile since free agency became an option in 1976. However, Weiler cites an empirical study showing that from 1951 to 1976, an annual average of 4.7 players per team moved to a different club via cash sales, trades, waivers, and other transactions; from 1976 to 1994, that figure remained essentially unchanged at 4.6. The difference is that under free agency, the players, instead of the owners, initiate these moves--and reap the financial rewards.

However, the movement of entire teams from one city to another--"franchise free agency"--began much earlier. In 1953, the Boston Braves moved to Milwaukee, the first baseball franchise relocation of the twentieth century. (In 1966, the Braves decamped again, for Atlanta.) But the most notorious franchise move in baseball history took place in 1956 when Brooklyn Dodgers owner Walter O'Malley moved his winning and profitable club to Los Angeles despite near-unanimous opposition from both players and fans. In his 1992 book Baseball and Billions, sports economist Andrew Zimbalist, Ph.D. '74, quotes owner Bill Veeck on the subject: "The Brooklyn fans had become the symbol of the baseball fanatic. They were recognized by ballplayers throughout the league as the most knowledgeable in the country....The loyal rooters never doubted for a moment that their beloved Bums were as much a part of their heritage as Prospect Park. They discovered that they were wrong. The Dodgers were only a piece of merchandise that passed from hand to hand."

|

| PGA executive Gil Kerr '75 at PGA Tour Headquarters in Ponte Verde, Florida, where professional golfers compete in the Players Championship. |

Photograph courtesy Gil Kerr and the PGA |

Now fans all over the country have learned that disheartening lesson, thanks to some unusual economic characteristics of sports franchises. Antitrust law, for example, does not apply. "Each major professional sports league is a monopoly," explains Zimbalist, a professor at Smith College. "A monopolist reduces output below what a competitive level would be--fewer goods available means higher prices." In the past there have been truly competitive leagues, but they either merged with the dominant league, as with the American Football League in the 1960s and the American Basketball Association in the 1970s, or folded, like the United States Football League in the 1980s. Today, legal monopolies reign in all sports, enforcing an artificial scarcity of franchises. (Weiler believes they are arguably natural monopolies, due to the singular quality of "major-league" competition.)

"If Congress broke up MLB [major league baseball] into economically competitive National and American leagues," Zimbalist asks, "do you think that Washington, D.C., would be without a baseball team for 29 years? Would Sacramento, New Orleans, and Portland, Oregon, be without teams? No, they would not. The American and National Leagues would look at those cities the way Burger King and McDonald's look at a nice, busy intersection: be there before the other guy! Cities like New York might have four or five viable franchises; the Yankees' competitive advantage would disappear. And a league or team could not hold a city hostage, threatening to move unless the taxpayers build a new $500-million stadium.

"If Congress broke up MLB [major league baseball] into economically competitive National and American leagues," Zimbalist asks, "do you think that Washington, D.C., would be without a baseball team for 29 years? Would Sacramento, New Orleans, and Portland, Oregon, be without teams? No, they would not. The American and National Leagues would look at those cities the way Burger King and McDonald's look at a nice, busy intersection: be there before the other guy! Cities like New York might have four or five viable franchises; the Yankees' competitive advantage would disappear. And a league or team could not hold a city hostage, threatening to move unless the taxpayers build a new $500-million stadium.

"The weaker cities get held up first," he continues. "Their taxpayers build new ballparks, the teams gain $30 million to $60 million in revenue, sign better talent, and win more games. Then the owners in other cities say, 'To stay competitive, we need a new stadium, too.' At the end of the process, teams at the top of the heap, maybe in New York or Boston, say, 'Now we need a new stadium, too.' If they are in first or second place, that argument is less credible. Steinbrenner, for example, threatened to leave New York with the Yankees. I testified that he has $210 million in revenue, and there is no way he will leave that major market."

In Arlington, Texas, a group of investors including future president George W. Bush, M.B.A. '75, carried out a classic taxpayer shakedown, as reported in news media such as the New York Times. The group acquired the Texas Rangers baseball team in 1989 for $86 million. (Family contacts enabled Bush to borrow enough funds to invest $606,000 and acquire a 1.8 percent stake in the franchise. His fellow owners gave Bush an additional 10 percent and made him a managing partner.) Within a year, the new Rangers ownership threatened to move the team away from Arlington unless they were given a new ballpark.

Bush's connections helped convince the city of Arlington to use the power of eminent domain to seize extensive acreage around the ballpark and transfer ownership of that land to the Rangers. The government also put up 85 to 90 percent of the funds to build the ballpark, via bonds paid off mostly through an increased sales tax. The Ballpark in Arlington opened in 1994; four years later, Tom Hicks bought the Rangers for $250 million. Bush received $15 million, but the taxpayers who invested $135 million in the stadium alone got no proceeds from the sale. "The sales tax is a regressive tax," comments Zimbalist. "So the lower-income groups are disproportionately paying for that Rangers stadium, while the franchise's huge appreciation goes to people in the top 1 percent of the population."

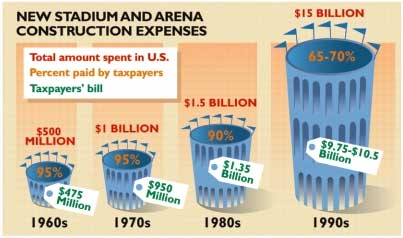

Football leads all sports in franchise relocations during the last 20 years. "They've had the best success in extorting money from the taxpayers," says Weiler. The NFL bans corporate ownership of its franchises, a fact that has political advantages, since, as Weiler observes, "It's much, much more difficult to get taxpayers to put up money for a stadium when Disney or AOL Time Warner owns the team."

Now, economists like Zimbalist have begun to question the investment of tax dollars in sports arenas while public services falter. Cleveland taxpayers, for example, spent $280 million to build a new stadium despite the fact that "Cleveland's schools are in receivership," says Zimbalist. The city of Chicago currently proposes to spend $500 million, including $300 million in public funds, to refurbish Soldier Field, home of the Bears. But "How much money do Bears fans actually spend downtown?" asks former Bear Dan Jiggetts. "There are 70,000 people coming in on 10 weekends each year. There's Chicago's infrastructure and schools to think about."

Subsidizing these new stadiums typically means a public referendum. "You start out with an owner who has megabucks and wants to convince the people to build a stadium," Zimbalist explains. "The owner lines up bankers, lawyers, labor unions, construction firms, and politicians behind the project. Spending on the referendum campaign is usually very one-sided. In Seattle, [Mariners owner] Paul Allen spent between $20 million and $30 million, while stadium opponents spent under $60,000. Despite the financial disparities, stadium referenda votes have been almost 50-50--almost half are rejected.

"There's a growing understanding by the citizenry that stadiums don't generate the economic development promised," Zimbalist continues. "The pro-stadium interests usually hire some consulting firm to do a 'study' that shows glowing economic benefits. But any independent economist who has studied the subject has concluded that building arenas and stadiums has no positive economic effect for the city or region." For such reasons, Zimbalist has become an outspoken critic of New York mayor Rudolph Giuliani's plan to spend a breathtaking $1.5 billion on new facilities for the Yankees, Mets, and Jets.

Weiler proposes a federal law, which he calls a "stadium cap," to prohibit state or local subsidies for a stadium structure. "It's the only way to protect taxpayers from monopoly power being used against them by owners threatening to move a team," he says. Weiler argues that the government can reasonably provide the infrastructure for such projects, but that private funds should pay for the structure. So far, Boston is the only metropolis in America that has gotten it right, he says; all its major league teams play in parks that the teams themselves have paid for.

Franchise free agents profit from the strong emotional appeal that sports teams have for fans. "Some feel that a city can only be a 'major-league city' if it has a major-league team," says Weiler. In that case, one must ponder the "major league" status of North America's second largest metropolis, Los Angeles. After 30 years with two football teams, L.A. has had no NFL franchise since 1995, when the Rams and Raiders departed for St. Louis and Oakland, respectively. (St. Louis built the $280-million Trans World Dome specifically to lure an NFL team to the city, whose Cardinals had decamped for Arizona in 1988.) Such moves reflect financial incentives that have created a deep cleavage between the interests of the fans, who typically want to keep their teams, and the owners, who can cultivate lucrative deals to move.

Weiler points out that in 1950, the great majority of pro sports teams played in private stadiums and arenas--in baseball, for example, only the Cleveland Indians played in a public ballpark, the cavernous Municipal Stadium they shared with the Browns. But in the 1960s, American cities began spending tax monies to build sports facilities, a trend that spiked sharply in the 1990s, when taxpayers poured $10 billion into such projects (see graph below).

|

| Chart by Stephen Anderson |

Before 1986, these municipal investments produced dividends, because public authorities received all stadium revenues except ticket sales--the proceeds, for example, of concessions and parking fees. But a new tax law that year changed this, by requiring that team owners garner 90 percent of all stadium revenues. Federal taxpayers, via tax-exempt bonds, had been subsidizing about a third of stadium construction costs; the logic was that building a stadium with public tax-exempt bonds was cheaper than using taxable private bonds. But states without franchises, like the Dakotas, objected to paying for stadiums elsewhere.

Then-U.S. Senator Bill Bradley, a former pro athlete, was one sponsor of the 1986 Tax Reform Act, which in part declared that for bonds to be tax-exempt, no more than 10 percent of stadium revenue could go to municipalities. Bradley thought this would create a disincentive for cities to underwrite stadium construction. But that was "a huge mistake," says Weiler. "Instead, it allowed team owners to approach mayors and governors and say, 'We've got to get 90 percent of the stadium revenues to make bonds tax exempt." Stadium receipts surged in the late 1980s, from skyboxes, club seats, naming rights, arena advertising, and a huge increase in consumer demand to watch games in the new luxury stadiums. Thus, ironically, coincident with the major leap in public investment, stadium revenues were diverted from the public coffers into private hands.

Stadium revenues have now become a major cash cow. At the high end, the Washington Redskins annually reap about $80 million in stadium income. While stadium receipts go to the local team, the 31 NFL franchises share equally the $2.2 billion in annual revenue from the league's rich national television contract. Thus, even though she was leaving the nation's second-largest television market, the television revenue of L.A. Rams owner Georgia Frontiere was little affected by her team's move to St. Louis. And Frontiere's Rams, with a sweetheart lease to the new domed field, could keep nearly all of the stadium revenue stream in their new city.

The View from Row FF

Not only have fans been losing their teams, but even when teams stay put, fans are having a hard time getting into the stadiums they paid to build. In the 1990s, sports ticket prices rose four times faster than the Consumer Price Index, according to Weiler. He writes, "A typical family of four going to watch an NFL game ends up spending nearly $250 (two full days' pay for the average American worker) for ordinary seats, parking, and something to eat and drink. If that family wants to preserve its season tickets, it often has to take out a bank loan."

Season tickets, which account for more than half of ticket sales in every sport (and for the vast majority of seats in all sports but baseball), represent the core fan base. But they are becoming a luxury (see graph below). "Games are now much nicer to watch, and very expensive to watch," says Weiler. "There are a lot more hits and home runs than 30 or 40 years ago, and so much more talent now; with today's athlete salaries, there's a huge incentive to become a great player. And spectators are just so much more caught up in sports than they were four or five decades ago. The evidence is how much money there is flowing in."

|

| Chart by Stephen Anderson |

Star athletes earning huge salaries can sometimes produce memorable evenings. But Weiler is eager to put to rest the idea that the big paychecks drive up ticket prices. "[E]mpirical investigation has documented that free agency and higher salaries do not cause ticket prices to go up," he writes. "Recall that free agency came to baseball in 1976, and that in the next 10 years average salaries rose from $50,000 to $400,000. Yet during the same decade the average price of a baseball ticket actually dropped in real dollars....The true economic interaction of players and fans is that when ticket and other team revenues go up, this causes salaries to rise, rather than vice versa." Ultimately, athletes are paid a lot of money because team owners sign those big checks. As athletes' agent Musselman notes, "I've never been in a free-agent negotiation where an owner was forced to do anything."

When urban fans do dig deep for those tickets, a close, exciting game is the best way to send them home as satisfied spectators. This underlines another peculiarity of sports economics: the interdependence of franchises. Contests between two opponents are synergistic by nature. Exciting competition arises from closely matched rivals; as in drama, suspense holds the audience.

In this sense, too, the national pastime is in trouble. "[C]ompetition on the playing field has become acutely imbalanced," writes Zimbalist in a foreword to the second edition of Bob Costas's book Fair Ball. "Since 1995 only three out of 189 postseason games have been won by teams in the bottom half of the payrolls. That is, these teams have less than one chance in 50 of qualifying for and then winning a postseason game..."

Free agency and vast revenue disparities between teams in small markets (like Pittsburgh) and large markets (like New York) combine to doom small-market clubs, which cannot hope to retain their star players once they become free agents. The Milwaukee Brewers simply cannot bid against the New York Yankees, whose $113-million payroll was the largest in baseball last year. (With an array of developed and purchased talent, the Yankees have won three consecutive World Series.)

Although the Yankees may epitomize the problem of revenue disparity, it affects baseball generally, and it has grown apace. In 1989, the revenue difference between the richest and poorest teams in major league baseball was $30 million; by 1999 that gap had grown more than fivefold, to $160 million. Unlike football, most of MLB's $900 million in television revenue came from local contracts ($560 million), with the national contracts--the chunk that franchises share in equally--bringing in only $340 million.

In July 2000, a panel commissioned by baseball commissioner Bud Selig proposed a plan that involved enhanced revenue sharing among teams, additional player market restrictions, and changes in the sport's draft system. The proposals overlap substantially with Weiler's recommendations in Leveling the Playing Field. "Revenues must be redistributed from the big-market to the small-market clubs--particularly local broadcast revenues, which depend almost entirely on population size," says Weiler. "The object of revenue sharing is to provide all clubs with a relatively equal pool of money to use in competing in the players' market. Redistribution will mean that the outcome of sports contests won't depend simply on the wealth of the franchise."

Weiler adds, however, that teams with smaller revenues "should not expect a charitable donation--they need to pay the richer teams the value of the revenue stream they get. The Montreal Expos, for example, were sold recently for $80 million, while a new partnership bought the Yankees for $650 million. Someone who has paid eight times as much for the franchise should not have to donate its income to smaller-market clubs." The San Francisco Giants are now making far more money than the Oakland Athletics, across San Francisco Bay. One reason is that the Giants play in the beautiful Pac Bell Park, which the team's owners paid more than $300 million to build. The Athletics, one of baseball's most vociferous advocates of greater revenue sharing, did not pay a dime for their stadium. Weiler notes that revenue sharing must consider such discrepancies in capital investment; he says that arbitrators from the financial markets should be able to hammer out an equitable formula.

Such reforms might ensure that baseball does not become just another marketplace, where victory is auctioned to the highest bidder. Different adjustments might remedy the dilemmas that other sports face. And this is a game worth playing. As financial priorities shape more and more of daily life, one motive for watching athletics is to escape--momentarily--the tyranny of the dollar. Once the game begins, money, agents, publicists, endorsement contracts, corporate advertising, and media coverage become largely irrelevant. Indeed, sports may be the last refuge of pure meritocracy. "The athletes are after perfection, and only perfection, in what they do," says Peter Carfagna. "And that's what makes us want to watch them."

Craig A. Lambert '69, Ph.D. '78, is deputy editor of this magazine and author of Mind Over Water: Lessons on Life from the Art of Rowing.