Harvard’s endowment was valued at $30.7 billion last June 30, the end of fiscal year 2012—a decline of $1.3 billion (4.1 percent) from the prior year. That result, released September 26 in Harvard Management Company’s (HMC) annual report, reflects an investment return of -0.05 percent on endowment and related assets, following the robust return of 21.4 percent in fiscal 2011. The decline in the endowment’s value reflects the investment return (essentially nil); minus distribution of endowment funds to support University operations and for other purposes (perhaps $1.5 billion; the exact sum will be reported in late October); plus gifts received. Endowment distributions account for about one-third of Harvard’s annual revenues.

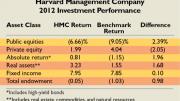

Domestic equities yielded a return of 9.65 percent, but international stocks declined sharply, producing an overall return of -6.66 percent for public equities—about one-third of the invested assets. Private equities and absolute-return assets (principally hedge funds)—together, about 30 percent of assets—yielded slightly positive returns. Fixed-income holdings (about 10 percent of the total) yielded 7.95 percent. Real assets were mixed, with strong gains in real estate, positive returns in natural resources (timber- and farmland), and significant losses in the commodities portfolio.

Peer institutions’ results demonstrated the important interplay of endowment investment returns, spending, and gifts from capital campaigns. At Yale, a 4.7 percent investment return for fiscal 2012 nearly offset distributions of about $1 billion, so the endowment declined only marginally during the year, from $19.4 billion to $19.3 billion. Stanford’s investments earned only 1 percent, but the endowment rose 3.2 percent in value, to $17 billion, as a surge of campaign gifts apparently more than offset nearly $900 million in spending.

HMC president and CEO Jane L. Mendillo cautioned that “at a time of unusual turbulence with significant macroeconomic issues facings regions around the world…future returns may be uncertain,” but expressed confidence in a strategy of focusing on highly diversified investments and “long-term value creation.”

For a detailed report on Harvard’s endowment performance, see https://harvardmag.com/endowment-12.