When physicist Eric Mazur’s research group created a new material called black silicon one day in 1998, he knew right away they were on to something. The material absorbs 50 percent more visible light than regular silicon, making possible uses easy to imagine—in solar panels, for instance. But the material also has unusual capacity to detect infrared light, giving it potential applications in the defense, automotive, telecommunications, and electronics industries (see “A Sponge for Light,” May-June 2002, page 12).

Mazur, now Balkanski professor of applied physics and professor of physics, remembers approaching someone in what was then the University’s Office of Technology and Trademark Licensing (OTTL) about patenting his discovery. The response was, “No, this is not interesting.” Mazur dropped the idea. A few months later, he spoke about black silicon at a meeting of the American Physical Society: “I said, ‘It could be used for this. It could be used for that.’ I was freely talking about it, because”—supposedly—“it wasn’t worth patenting.” But with each statement, by putting his ideas in the public domain, Mazur was unknowingly closing off a possible patent for Harvard. “When I came out of my talk, the Los Angeles Times, The Economist, Discover magazine—they were all there to interview me,” he recalls. The word was out.

After the media flurry, OTTL had second thoughts, Mazur says. “They came to me and said, ‘Well, maybe we should do something.’ But it was too late. We lost the chance of protecting the basic idea.” Harvard now holds patents to two applications of black silicon and continues to apply for more, but the University is still paying for that sin of omission; Mazur planned to travel to the U.S. Patent Office in December to defend an application.

Mazur’s experience may stem from one bad decision, but it is also emblematic of a subsequent transformation. During the last five years, the University has completely retooled the way it handles commercializing professors’ inventions and innovations, a process known as technology transfer. The metamorphosis involved combining two offices and rechristening the merged entity the Office of Technology Development (OTD, https://otd.harvard.edu), hiring a new director, and systematically updating Harvard’s intellectual-property policies.

Mazur has a unique vantage point as someone hampered by the old office and helped by the new one. He has been on the Harvard faculty since 1984, but his name was on just one patent application prior to 2002; since 2002, his lab has filed a dozen. In 2005, with funding from three venture-capital firms, he founded a company called SiOnyx that is developing applications for black silicon and expects to launch its first product soon. Now, Mazur’s name appears on a list of OTD “success stories”—recent start-ups spun off from work in University labs—as evidence of a burgeoning entrepreneurial spirit at Harvard. With OTD’s help, he is negotiating with “a major established company” that wants to develop another idea from his lab into a product. The difference between the new OTD and the old OTTL, Mazur says, is “black and white.”

That was the goal. “Harvard has a remarkable research presence,” says Steven E. Hyman, a professor of neurobiology who was appointed provost in 2001. “We produce an enormous number of important and highly cited new papers every year. But we had been relatively slow to commercialize our discoveries, and as a result, many potentially important discoveries…sat on library shelves.…I actually think that it is part of the mission of a research university not only to publish papers, but also to get discoveries out into the world.”

Hyman assembled a faculty committee in 2004 to set priorities for changing technology transfer at Harvard and mounted a search for someone to lead the charge. In May 2005, Isaac T. Kohlberg became the University’s associate provost and chief technology development officer. Kohlberg, who has an LL.B. and an M.B.A., had held analogous positions at the Weizmann Institute of Science in Israel, New York University, and Tel Aviv University.

At Harvard, Kohlberg integrated the separate technology-transfer office at the Medical School into a unified operation that would report to Hyman. (OTTL had reported to the vice president for finance.) He expanded the office’s staff by 40 percent, to 35 people—about the same size as MIT’s office—and focused on hiring colleagues who understand science and business and take a proactive approach. (Here, too, Mazur’s story is illustrative. He says someone from OTD visits him “every couple of weeks, if not more...constantly trying to connect us to companies to see if there are mutual interests, and I think that’s great.”)

Kohlberg has emphasized formal networking, but also the informal interactions that may unearth unrecognized opportunities, and lead to trust. (He keeps an espresso machine in his office to fortify professors and business leaders who drop in.) He hopes to involve more alumni, too—as faculty mentors, angel investors, chief executives, or enthusiasts who spread the word to friends and thereby increase the chance of making a match between an idea and a company to develop it. “If you look at any major corporation or any venture-capital group, in the country or internationally, you will always find a Harvard connection,” Kohlberg says. “The question is, how do we build on this? How do we leverage this?”

Since Kohlberg arrived, licensing revenue—the amount of money the University makes from agreements for the use of technology on which it holds patents—has actually declined from $27.9 million in fiscal 2005 to an estimated $15 million for fiscal 2008, mostly reflecting the expiration of a patent for Cardiolite, a technology for diagnosing coronary-artery disease. Either number is low compared to some of Harvard’s peers. The Wisconsin Alumni Research Foundation, the licensing arm of the University of Wisconsin, reported income of $48.9 million in 2005, largely because of patents to the anticoagulant drug Coumadin, to vitamin D, and to technologies related to stem cells. Columbia—which holds patents to a technique for inserting foreign DNA into host cells to cause them to produce specific proteins, for pharmaceutical applications—reported $116 million in licensing income for 2005, and Stanford reported a whopping $384 million, $336 million of which it earned by selling Google stock. (Google’s founders developed the search technology while they were graduate students at Stanford, so the university holds the patent.)

But Kohlberg says this is not the measure that matters. For one thing, licensing revenue is a lagging indicator; changing the way Harvard handles licensing won’t produce noticeable results for about a decade. He tracks success in other ways. The number of invention disclosures, for instance, has jumped from 160 in fiscal 2004 to 222 in 2007. That’s far below the 520 invention disclosures filed at MIT in fiscal 2007, but Kohlberg considers the trend a vote of confidence. Professors are not required to file the forms, which might be considered precursors to patent applications, so when they do, it indicates trust in OTD to weed through the paperwork and file for a patent if warranted.

Harvard now has an “accelerator fund” to advance research that holds commercial promise, but which isn’t yet at the “Kitty Hawk point,” as Kohlberg calls it—ready for takeoff . The initial round of funding allocated $1.3 million among six life-sciences projects, including research by professor of chemistry and chemical biology Andrew Myers, who is developing an anticancer drug derived from marine fungus. Even though such a drug holds huge potential for healing (and profits), pharmaceutical firms won’t commit to developing it until there’s a reasonable probability they’ll be able to create a product that works. Harvard’s funds will pay for initial studies—for instance, on toxicity—so there’s less likelihood of a late-stage finding that would make marketing the drug impossible. (There are plans to extend the accelerator fund to engineering and the applied sciences, and to bioengineering.) In another eff ort to address the so-called “development gap,” Partners HealthCare—the parent organization for two of the Medical School’s largest teaching hospitals, Brigham and Women’s and Massachusetts General Hospital—has set up its own internal innovation fund (www.partners.org/civ), like OTD’s, to nurture early work on medical devices and therapies emanating from its researchers’ labs.

In a separate project, Myers is one of the founders of Tetraphase, a company that is developing antibiotics with potential to fight infections resistant to the drugs already on the market. Myers’s lab was the first to develop a completely synthetic form of tetracycline, rather than start with biological material. Kohlberg’s eff orts have helped jump-start entrepreneurial thinking at Harvard and encourage ventures like SiOnyx and Tetraphase, says Richard Hamermesh, MBA Class of 1961 professor of management practice, who has written a case on technology transfer at U.S. universities. “It’s in the DNA of MIT,” Hamermesh says. “It’s in the DNA of Stanford. It’s not in the DNA of Harvard.”

What it lacks in genes, Harvard is trying to contribute through environment. With presenters from OTD and the business world, Harvard Business School (HBS) held a day-long symposium for professors last spring on “Realizing the Potential of Your Innovations.” Sessions explored the anatomy of a start-up deal, the roles of patents and licensing, and ethical considerations; about 80 people attended. Also at HBS, a course titled “Commercializing Science and High Technology” is in its fourth year. Taught by assistant professor Lee Fleming, the course enrolls students from across the University—the Faculty of Arts and Sciences and the schools of law, medicine, engineering, government, and public health, as well as business. The students evaluate real invention-disclosure forms from Harvard professors, with the aim of turning some of them into businesses.

Kohlberg and Hyman have also nudged the University out of its ambivalent posture toward industry-sponsored research. Harvard recently signed a deal with Cambridge-based Vertex Pharmaceuticals under which Vertex will fund research in oncology, infectious disease, immunology and inflammation, and neurodegenerative diseases. The company and OTD have already solicited proposals from Harvard labs and will soon announce funding awards.

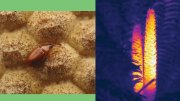

Courtesy of Eric Mazur

Irradiating a silicon wafer with laser pulses in the presence of certain gases (above) causes clusters of spikes to form (below). The resulting material, called black silicon and developed in Eric Mazur's physics lab, captures almost all light that strikes it.

Courtesy of Eric Mazur

Vertex president and CEO Joshua Boger, Ph.D. ’79, says the firm will not influence what happens in Harvard labs any more than the National Institutes of Health and the National Science Foundation do through their choices of which projects to fund. Harvard retains intellectual property rights to any discoveries made with Vertex money. There are no restrictions on publication or disclosure of the results. Vertex will get some preference in licensing future inventions that result from its funding, but the advantage, Boger says, is “very weak.” Why do it if there is no guaranteed payoff for Vertex? “These are areas of science that we think need to advance for us to do things that we’re interested in,” he replies.

Boger notes that he founded Vertex in 1989 and has a certain fondness for his doctoral alma mater, but had not previously worked with the University because, he says bluntly, “Harvard has long had a reputation as one of the most difficult institutions in the country to work with.”

That is changing. The dollar value of industry-sponsored research at Harvard increased by 70 percent from 2006 to 2007 alone, and there is more to come. In another recently announced deal, the multinational chemical company BASF will support 10 postdoctoral fellows and inject $20 million during five years into labs at the School of Engineering and Applied Sciences. Merck has agreed to fund basic research in six programs at the Medical School. Such collaborations will grow more common as the University’s historic ambivalence toward corporate funding of scientific research diminishes and as trends in federal funding necessitate them. “I can’t overstress the importance of this kind of funding…at a time when the federal government is really in the doldrums” in terms of support for scientific research, Hyman says.

He says he has not encountered the resistance he expected from the faculty. “I was told when I got here that I would meet a firestorm of protest about having a more aggressive technology-transfer office,” Hyman says. Instead, he says, “I’m getting a diff erent kind of complaint. ...I’ve heard from some venture capitalists that Isaac drives too hard a bargain on Harvard’s side. I can live with complaints like that.”

The University’s agreements with industry have passed muster because Harvard has been extremely judicious in the way it structured them, Kohlberg says. As with the Vertex deal, he says, “All the projects are faculty-initiated. They are not contract research. There is no limitation on the public dissemination of the results of the project. There is no direction by the company on the project.” Indeed, the terms of these deals differ significantly from corporate partnerships some other universities have signed—notably, Berkeley’s agreements with BP and Novartis. The Novartis agreement, reached in 1998 and already concluded, gave the drug company veto power over the university’s ability to patent the findings of research the company funded, and the first rights to negotiate on any patents coming out of the university’s department of plant and microbial biology—whether or not the company funded the underlying research. The BP agreement, which is new, involves proprietary labs on university property.

Kohlberg also aims to make Harvard a leader in what is called “socially responsible licensing”—enabling the developing world to benefit from innovative research. This is where it becomes clearly apparent that control over how an invention is used, and not profits, can be the chief motivation for seeking a patent. OTD recently licensed a new vaccine technology developed by Lehman professor of microbiology and molecular genetics John Mekalanos to a China-based venture-capital company for commercial development—but retains the rights to license the technology to governments and humanitarian groups in the developing world. With regard to an inhaled tuberculosis vaccine spray invented by McKay professor of the practice of biomedical engineering David A. Edwards, Harvard is forgoing royalties from sales in developing countries and donating royalties from sales in developed countries to Medicine in Need, a nonprofit Edwards founded.

Academic ambivalence toward commercialization largely stems from a fundamental misunderstanding, says Flowers University Professor George M. Whitesides, a chemist whose name is on more than 50 Harvard patents and 160 patent applications, and whose work has spawned more than a dozen startups, including Genzyme, over the years (see “Patent Portfolio,” September-October 2007, page 70). Whitesides, who is one of the directors for the BASF project, spent two decades on the MIT faculty before coming to Harvard in 1982. “The idea that there’s something intrinsically better about doing things that are useless, as opposed to doing things that have the potential to be useful, is an incorrect formulation,” he says. Seeking to apply research is “not getting your hands dirty. I mean, what’s dirty about trying to help your mother live for another five years, or trying to make a better communications system, or trying to make engines that are twice as efficient?” he asks. “Society pays us not to write papers, but ultimately to solve societal problems.”