Diversification pays. So do effective investment disciplines. Those are the two signal lessons from recent Harvard Management Company (HMC) stewardship of the University's endowment funds. The return on investments, after all expenses, was -0.5 percent for the fiscal year ended June 30.

As most individual investors know, the "investment climate was once again harsh" during that period, as HMC president Jack R. Meyer, M.B.A. '69, describes it, with "sharply negative" returns for the major U.S. equity markets, including private equities such as venture capital. "We may not be out of the woods," Meyer wrote in September, in his annual letter reviewing performance, "but the endowment has weathered the two-year storm in fine shape." (During those two years, the chief U.S. stock-market indexes declined 32 percent and 63 percent.) But coming out of that storm, the endowment's ability to propel further growth in University spending on its academic priorities may need to be reexamined.

In absolute terms, the endowment was valued at approximately $17.5 billion at the end of the fiscal yeardown from $18.3 billion at the end of fiscal year 2001, and a peak of $19.1 billion the year before. The decline, which Meyer terms disappointing, reflects three factors. First, the rate of return on investments has now been negative for two consecutive years (following the -2.7 percent return in fiscal 2001)a first in modern Harvard endowment history. Second, and far more important, is the actual distribution of funds from the endowment, a sum that now totals $750 million or so annually and constitutes the largest single source of revenue for Harvard's programs and operationsabout 30 percent of the total. Finally, the endowment varies with the net amount of gifts received. In the most recent fiscal year, Meyer estimates, gifts totaled about $150 million, or half the funds received during the prior year.

On a relative basis, that modestly negative -0.5 percent investment return is cause for celebration. The indexes against which HMC benchmarks performance in its diverse classes of invested assets produced a -4.5 percent return, and the median fund with which the Harvard endowment is compared yielded -5.9 percent. Although that means HMC achieved a narrower margin of superiority over peer funds than in the prior year, the University is still fortunate. Had HMC only matched the benchmark returns for its model "policy portfolio" or run at the median institution's return, Harvard would be $800 million to $1 billion less well endowed.

HMC's fiscal year 2002 results reflect "consistency across asset classes," Meyer says, a result that "pleases us." As might be expected in a year of sluggish economic growth, low and declining interest rates, and poor stock-market returns, fixed-income investments (about one-quarter of assets) drove the endowment performance overall. Foreign bonds returned 32.4 percent, more than twice the benchmark; domestic bonds returned 14.8 percent, more than 5 percentage points above the benchmark; and the portfolio of inflation-indexed bonds, a relatively new category for HMC, returned 9.2 percent.

Equity holdings40-plus percent of the assetswere laggards, with one exception. Domestic stocks yielded -12.2 percent. Private equities were even weaker, returning -19.7 percent; Meyer notes that even though venture-capital firms remain awash with excess cash and returns remain terrible, over time Harvard has had extraordinary results from such investments and seeks to maintain its position with the top outside managers. Foreign stocks had negative returns as well. But the smaller emerging-market portfolio returned 7.5 percent. In all four categories of equities, HMC managers exceeded benchmark returns.

The other strongly positive investment class was "absolute return": hedge funds, which can sell securities short or invest in special situations. Here, returns totaled 10.2 percent, versus a negative result for the benchmark. Commodities investments (oil, gas, and timber) produced a modestly positive return well ahead of market results, and the high-yield portfolio matched the benchmark's essentially break-even result. Only in real estate did HMC trail the marketa difference Meyer attributes to timing. Harvard appraised its properties at the end of its fiscal year, and so reflected current market values for the kinds of opportunistic investments it makes. Most funds will do their appraisals at the end of the calendar year. "There should be some pain" then, Meyer says, "and we haven't seen it yet in the benchmark."

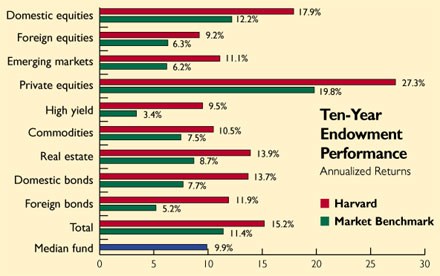

In broader perspective, HMC continues to compile admirable records. Its 10-year annualized rate of return (see chart) reflects outperformance in every class of investments for which a record that long exists. The 15.2 percent annualized rate of return for the endowment overall exceeded inflation by 12.5 percentage pointsdouble HMC's long-term goal of a 6 percent real rate of return. The realized rate of return also exceeded the market benchmark for the policy portfolio by 3.8 percentage points, and the median institutional fund by 5.3 percentage points annually over the past decade. In absolute terms, that means $8 billion of value added relative to the median fund's performancenearly half the total endowment today. (Since HMC staff are compensated on the basis of relative performance, many of them will again, as in recent years, earn large bonuses, despite the negative absolute return on endowment investments.)

In terms of supporting University finances, Meyer notes, "spending has not faltered." In fact, endowment distributions for Harvard's use have roughly tripled during the past 10 years, and doubled during the past five.

But looking forward, the prospects are cloudier. "Our board is fairly accustomed to outperformance now," Meyer says, noting the 3.8 percentage-point margin relative to market performance compounded over the past decade; he would be more comfortable guiding expectations to a sustainable 1-point margin over time.

As for spending on University programs, he thinks the current rate of distributions from the endowment is sustainable, assuming investment returns of 6 percent or so above the rate of inflationimplying nominal returns of 8 to 9 percent. "I think that's doable over the next five to 10 years," Meyer says, if not immediately or in any given period. "But that would not allow for any dramatic increases in real spending" of the sort deans and faculties have become accustomed to of late. Given plans for expensive new science facilities, faculty growth, and other prioritiesnot to mention the much longer-term development of Allston properties for academic useMeyer's forecast is an important element in the University's aggregate financial picture. In this light, the early twenty-first century looks very different from the late 1990s.