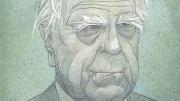

The financial crisis and ensuing Great Recession surprised most economists and policymakers, writes David M. Kotz ’65, professor of economics at the University of Massachusetts, Amherst (and Distinguished Professor at the Shanghai University of Finance and Economics). Depression-like collapses were thought to be “no longer possible in contemporary capitalism.” But he reinterprets these economic difficulties in The Rise and Fall of Neoliberal Capitalism (Harvard, $39.95). From the introduction:

In 2008 a severe financial and broad economic crisis broke out in the United States. It rapidly spread to much of the global financial and economic system.…While the acute stage of financial collapse and economic free-fall at the start of the crisis has passed, it has been followed by a period of stagnation and economic instability….

This crisis issued from the particular form of capitalism in the United States in recent decades, often called free-market, or neoliberal, capitalism. Neoliberal capitalism arose around 1980, first in the United States and the United Kingdom, replacing the quite different “regulated capitalism” that had preceded it. It soon spread to many, although not all, other countries, and came to dominate the global-level economic institutions of this era.

…In brief, in neoliberal capitalism market relations and market forces operate relatively freely and play the predominant role in the economy. By regulated capitalism we mean a form of capitalism in which such non-market institutions as states, corporate bureaucracies, and trade unions play a major role in regulating economic activity, restricting market relations and market forces to a lesser role in the economy.…

[T]he crisis that began in 2008 is not just a financial crisis, or a particularly severe recession—or a combination of the two. It is a structural crisis of the neoliberal form of capitalism.…[T]he crisis, unlike an ordinary business cycle recession, cannot be resolved within the current structural form.…Even a bold Keynesian policy of fiscal expansion through big increases in public spending, while capable of stimulating faster economic growth and creating more jobs for a time, would not in itself resolve the underlying structural problem that is blocking a resumption of a normal trajectory of profit-making and economic expansion over the long run. Rather, major structural change in the economy and other related aspects of society represents the only route to resolving the current crisis, a view that finds support from the history of the resolution of past structural crises in the United States such as that of the 1930s.