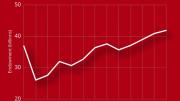

Harvard Management Company (HMC) reported a 7.3 percent return on endowment assets for the fiscal year ended June 30, 2020. The endowment’s value on that date was $41.9 billion: up $1.0 billion (2.4 percent) from $40.9 billion a year earlier. In a volatile year for investors (the pandemic and resulting economic fallout depressed the securities markets late last winter and early spring, before enormous monetary and fiscal stimulus programs prompted sharp recoveries), HMC’s rate of return, which is net of all investment expenses, actually exceeded the 6.5 percent it realized in fiscal 2019.

In a succinct statement accompanying the September 29 announcement, HMC’s chief executive officer, N.P. Narvekar, said, “As we continue to make progress in the five-year transition of HMC and our investment portfolio, we are mindful that there is much left for us to accomplish. Our team remains confident that the changes being made to both the portfolio and the organization’s systems, structure, and culture will serve the University well and generate the long-term returns on which Harvard relies.”

That reliance was especially clear this year, as University revenues have declined by hundreds of millions of dollars (reflecting the shutdown of many executive-education programs, spring room and board rebates, fall declines in tuition and fees, and more), even as costs for operating during the pandemic have increased by tens of millions of dollars. The endowment is normally a predictable source of yearly funds, but during the financial markets’ spring turmoil, deans were advised that endowment distributions—the largest source of revenue, accounting for about 35 percent of Harvard’s annual budget—would be reduced during the current fiscal year, rather than increased as they had expected. In early August, the Corporation, more confident, decided to level-fund the distribution, instead. And on September 29, reflecting the unexpectedly good endowment returns, President Lawrence S. Bacow told the community that the central administration would distribute an additional $20 million from its funds to schools, affiliated museums, and other units, helping deans and directors pay the bills for adapting to the pandemic.

Detailed investment results await publication of Harvard’s annual financial report in late October (after this issue went to press). Until then, the factors contributing to the 2.4 percent rise in the endowment’s value cannot be known exactly. But a rule-of-thumb estimate suggests that beginning from the $40.9-billion value at July 1, 2019:

- the investment return during fiscal 2020 boosted the endowment by perhaps $3 billion;

- the distribution of funds to pay for University operations decreased the endowment by roughly $2.0 billion; and

- gifts for endowment increased its value nominally—in any event, likely less than the $600-million increments during the past two fiscal years, in the wake of the extraordinarily successful Harvard Campaign.

Other institutions reporting results by press time included MIT (which earned 8.3 percent on investments in fiscal 2020, down from 8.8 percent the prior year); and Yale (6.8 percent, up from 5.7 percent the prior year).

Full coverage of HMC’s initial announcement of results appears at harvardmag.com/endowment-20. Check back at www.harvardmagazine.com for further information about the endowment and analysis of the University’s annual financial report.