Could wealth accumulation by the rich in the United States have contributed to a savings glut so great that it has forced down interest rates? The inexplicably low cost of borrowing that has persisted worldwide for nearly two decades is often attributed to demographic forces, as workers in countries with aging populations, such as Germany and Japan, save for retirement. Ben Bernanke ’75, famously referred to a “global savings glut” in 2005, before he was appointed chairman of the Federal Reserve Board, to explain the flows of capital into the United States from savers around the world. A similar demographic explanation for low rates has been applied domestically, where saving by baby boomers, it has been argued, has contributed to a national savings glut, and a corresponding rise in the prices of assets ranging from equities to homes. But now, even as the boomers enter retirement and begin spending their savings, the domestic glut persists, asset prices remain high, and interest rates remain low. Demographics can’t explain that.

Assistant professor of economics Ludwig Straub and colleagues at the National Bureau of Economics Research (Atif Mian of Princeton, and Amir Sufi of the University of Chicago’s business school), say they have identified a key cause: the savings rate among the 10 percent of the U.S. population with the highest income is dramatically higher, and has been growing faster, than savings among the remaining 90 percent. The scale of saving by the rich and its continued growth as a share of total saving—reflecting rising income and wealth inequality—is large enough, the research suggests, to have effects that could damage the U.S. economy.

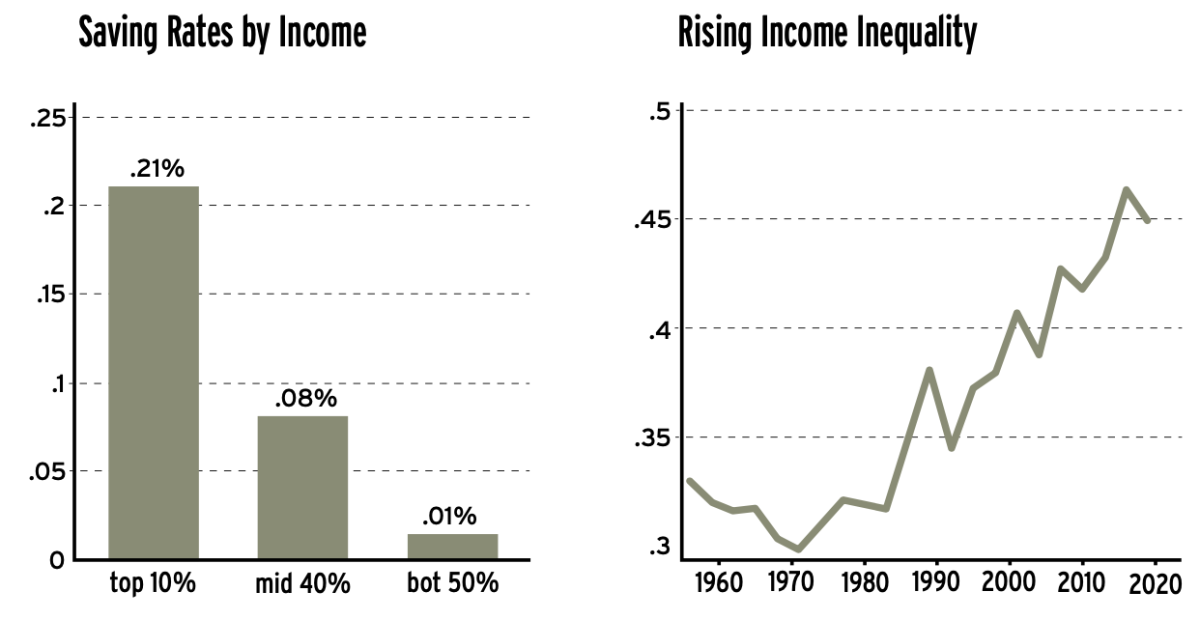

Straub and colleagues document a significant increase in domestic savings entering the financial system between 1995 and 2019. They show that most of that new money, used to purchase assets such as stocks and bonds, comes from high-income households: 30 to 40 percent of total private saving in the U.S. economy. After sorting U.S. households into 10-year birth cohorts (by birth year of the head of household), the researchers found that the savings rate of the highest-earning 10 percent in any given birth cohort is 10 to 20 percentage points higher than the savings rate of the bottom 90 percent. Looked at another way (in a previous paper, “The Saving Glut of the Rich”), the magnitude of average annual savings by the wealthiest one percent is comparable to the savings entering the United States from abroad—Bernanke’s aforementioned “global savings glut.” And even as top earners save relatively more each year, the bottom 90 percent, they found, have been dissaving: the trend has been toward slightly more borrowing, but more importantly, a decline in the accumulation of assets, from real estate to retirement funds.

Left: Estimated saving rates as a percentage of income in the United States, 1953-2019. Right: The share of total income earned by the top 10 percent of U.S. earners. (For both graphs, income levels were assigned within 10-year birth cohorts, i.e., the top 10 percent among earners born between 1935 and 1944, 1945 and 1954, etc., to control for demographic influences on the data.)

Source: https://scholar.harvard.edu/straub/publications/what-explains-decline-r…

Low interest rates are great for borrowers, but create potentially dangerous macroeconomic risks. One is secular stagnation—a long period with little or no economic growth. Much of the saving by the rich, Straub and his colleagues found, is being used to purchase equity in non-financial companies, for example. Those companies are awash in cash, and park some of it in instruments such as low-paying government bonds, which effectively underpin lending, including that for mortgages. And that brings the cost of borrowing down, but is not considered productive investment that will expand the economy.

Another risk is asset-price bubbles, like the one in U.S. housing markets that precipitated the Great Recession in 2008. When large amounts of savings chase a limited quantity of assets, such as stocks or real estate, prices are bid higher than their economic value, and a shock collapse can ensue. Fortunately, Straub said in an interview, the high savings rate of top earners doesn’t seem to be associated with the risk of a financial crisis now: “Although we see an increase in prices, we don’t see an associated increase in household debt” as was the case in the pre-recession housing bubble.

But low rates also deprive policymakers of an important tool for responding to economic crises, Straub explained: during an average recession, central banks “typically reduce their policy rates by around 5 percent” to stimulate economic growth. But when the starting rate is “1 percent, or even zero as it is in Europe, it’s a massive restriction on monetary policy.” Central banks can purchase assets instead (increasing the money supply by buying government bonds or stocks, a process known as “quantitative easing”), but, he said, there is “only so much quantitative easing you can do before it is not effective anymore.”

Monetary policies cannot cope with the income inequality that the authors say underlies low interest rates. While “addressing income inequality might be important…to promote social cohesion, or for political reasons,” says Straub, the point of the research is that there may also be economic reasons for addressing the problem. As the researchers sum up, “Policymakers should recognize that rising income inequality is more than a distributional issue; it is likely a central force shaping broader macro-economic trends.”