“There could really be no more important discussion than the one we are having today,” said Kissel professor of law David Wilkins last Thursday, introducing a daylong conference that plunged into what has become an intensely controversial subject: ESG. That acronym is shorthand for a growing movement of corporations committing to environmental, social justice, and governance standards as a part of their business practices, and of investors increasingly holding corporations accountable not only for shareholder profits but also for the way they treat employees, customers, and the communities where they do business.

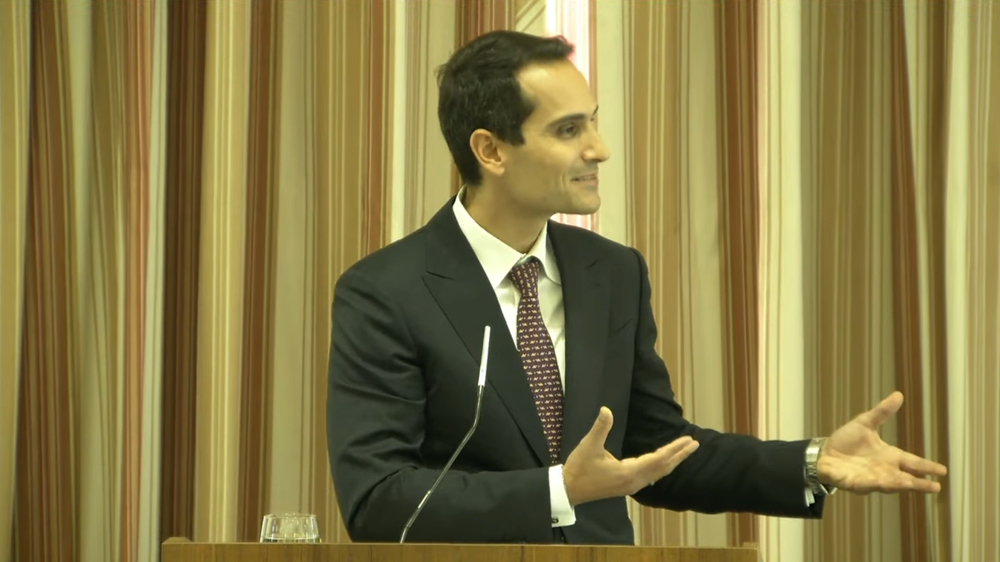

Kissel professor of law (and conference emcee) David Wilkins

Screenshot by Harvard Magazine

Titled “Reimagining the Role of Business in the Public Square,” the conference was organized by the Law School’s Center on the Legal Profession—which Wilkins directs—and co-hosted by Harvard Business School’s Institute for the Study of Business in Global Society (BiGS), the Harvard Kennedy School’s Center for Public Leadership, and the Harvard Data Science Initiative. The list of speakers included experts working in government, business, and the nonprofit world, as well as Harvard scholars in business, economics, law, and public policy. Microsoft CEO Satya Nadella and president and vice chair Brad Smith offered remarks, along with Gary Gensler, chair of the U.S. Securities and Exchange Commission (SEC), and Mitch Landrieu, White House senior adviser on infrastructure, who talked about ESG considerations for distributing the new infrastructure law’s $1.2 trillion in funding. Julia Hoggett, the CEO of the London Stock Exchange, offered an assessment of ESG investing from a European perspective. Leaders from social justice and environmental organizations also spoke, including civil rights attorney Sherrilyn Ifill, Social Finance CEO Tracy Palandjian (a new Harvard Corporation fellow), and two Harvard undergraduates: gun-control activist David Hogg and Divest Harvard organizer Connor Chung.

A panel discussion on "strategies for creating change," with (from left) Debora Spar, Tracy Palandjian, David Hogg, Connor Chung, and Molly Weiner

Screenshot by Harvard Magazine

The event also included several lengthy discussion sessions (all off-the-record) in which audience members dug into specific issues and case studies relating to ESG initiatives: sustainable finance, public engagement, the role of the board, metrics and indicators, workforce equity, ESG innovations in emerging economics, and government as a regulator and partner. “This is a working conference,” Wilkins said as the day began. “We want to really try to tackle the key issues around what kinds of commitments should be made, how do we make those commitments meaningful and measurable, and how do we hold people accountable for those commitments.”

University president Lawrence Bacow spoke briefly in support of ESG’s objectives, touting the newly created BiGS and the Salata Institute for Climate and Sustainability. The directors of both institutes—Tiampo professor of business administration Debora Spar and Burbank professor of political economy James Stock—moderated conference discussions.

Underscoring the conference’s concrete relevance to Harvard’s own future, Bacow reiterated the University’s goal of rendering its entire investment portfolio carbon-neutral by 2050. “We’re really biting off a big job,” Bacow said. “We have to establish benchmark conditions for the footprint of the investment portfolio. We also have to work with other institutions to establish processes for measuring change toward these goals. It’s not enough just to determine what we’ve bought and what we’ve sold. We need to figure out, for example, how we’re going to handle short positions that we have in companies with large carbon footprints; we need to figure out how we’re going to handle derivative positions. These are complex, difficult tasks.”

The growing threat of climate change is perhaps the biggest and best-known driver of the rise in ESG investing, but the movement encompasses a vast range of real-world concerns, including LGBTQ and women’s rights, workplace diversity, racial injustice, pollution, and environmental injustice. “It was a discussion that was going on before the pandemic,” Wilkins said, “but it has been turbocharged by the events of the last two and a half years, including the pandemic but also, of course, the protests over the murder of George Floyd, economic inequality, workforce equity, public health, and all the issues that are so much on the table today.”

The backlash has been turbocharged, too. Conservative politicians label ESG derisively as “woke capitalism,” and, especially during the past year, have initiated a number of heated public fights over issues under ESG’s umbrella: Florida governor Ron DeSantis’s feud with Disney over its criticism of a proposed bill (now a state law) banning classroom discussion of LGBTQ issues, Texas’s announcement that it would order state pension funds to divest from 10 energy companies that it accused of “boycotting” fossil fuels, and an investigation by Missouri’s attorney general into investment firm Morningstar for alleged bias against goods and services from Israel. In August, 19 Republican state attorneys general signed a letter to the CEO of BlackRock (one of the 10 companies Texas had targeted), accusing the investment manager of putting its “climate agenda” ahead of client interests.

The day before the Harvard conference took place, two divergent events illustrated the starkness of the debate: “We saw, for the first time ever,” Wilkins said, “members of the Senate Judiciary Committee aggressively question a nominee for the Third Circuit Court of Appeals”—Delaware Supreme Court Justice Tamika R. Montgomery-Reeves—“about her position on the role of boards in ESG.” That same day, Yvon Chouinard, the billionaire founder of the outdoor apparel-maker Patagonia, announced he had given away his entire company, transferring ownership to a trust and a nonprofit organization designed to ensure that all of Patagonia’s profits—about $100 million per year—would go toward fighting climate change. “It’s incredible,” Wilkins said.

More measured critics of ESG have taken issue less with the philosophical goals than with nuts-and-bolts reality of the movement: a lack of transparency and accountability from corporations, inconsistent or confusing measurements, false marketing, fuzzy data, flawed ratings, and a tendency to overpromise and under-deliver—on both the good ESG can do and the profits it can make. “Ballyhoo verging on baloney,” complained a 10-page special report in a July issue of The Economist, which analyzed the current state of ESG investing. (Other analyses have found more to praise about ESG, including in shareholder returns. An April article in the Harvard Business Review cautioned readers to think about the real—and in some cases existential—costs of previously unpriced factors like environmental destruction, and to pay attention to long-term versus short-term gains: “There are technologies that may cost more now, until they get to larger scale—which describes every new technology.”)

The conference offered dose of ESG skepticism in a presentation by Lucien Bebchuk, Ames professor of law, economics, and finance, and founding director of Harvard Law School’s Program on Corporate Governance. Bebchuk shared some results from recent research on companies that had pledged commitments to a broad range of stakeholders. Despite those commitments, he said, the corporations’ director pay still remains strongly tied to stock prices, rather than to ESG metrics. Bebchuk also analyzed corporate acquisitions during the first two years of the COVID-19 pandemic—100 transactions, totaling more than $700 billion altogether—and found that business leaders negotiated large premiums for their shareholders and benefits for themselves, but “despite the heightened vulnerability for stakeholders during the pandemic, corporate leaders generally chose not to share the deal gains with stakeholders,” he said. In general, they did not negotiate protections for employees, nor compensation for those who would lose their jobs, nor protections for communities, customers, or the environment. “Stakeholderism,” Bebchuk argued, would serve to “insulate corporate leaders from shareholders and make corporate leaders less accountable to anyone.” To the audience, he implored: “Please direct your energy and efforts to obtaining real stakeholder protections through governmental interventions that would constrain and incentivize companies from the outside.”

(In a conversation soon afterward, Satya Nadella, CEO of Microsoft—which since 2016 has tied a portion of executive pay to ESG goals—explained that he would welcome more governmental regulation, especially regarding the use of artificial intelligence and facial recognition technology, but also in social and environmental issues more broadly: “Our regulatory frameworks, in fact, make our markets more competitive, not less competitive, globally.” He noted the success of laws governing clinical trials of new drugs, and the dangers of no-rules innovation in business. “In the long run, that’s going to catch up to you,” he said. “You are going to break something very, very big, and something very, very bad is going to happen.”)

In its own analysis, The Economist considered research findings similar to the ones Bebchuk outlined. Even so, the magazine concluded, “it may be better to overhaul than to bin ESG.” For one thing, the kinds of governmental regulations that Bebchuk and others advocate—for instance, taxes on carbon emissions—have been exceedingly difficult to pass in the current political climate, at least in the United States. Plus, “At its core,” The Economist wrote, ESG “is a quest for something increasingly crucial in the battle to improve capitalism and to mitigate climate change.”

A similar theme kept bubbling up throughout the conference—not only that improving ESG is better than getting rid of it, but that, in fact, it may be the only choice. Again and again, speakers, from corporate executives to social activists, made one thing clear: ESG is here to stay. “Most of the CEOs I know would rather just run their company, but that’s not an option anymore,” said Joshua Bolten, CEO of Business Roundtable, a lobbying association of executives from leading American companies. “The customers, and especially the employees, expect to have the values of the corporation expressed in some way by the leadership of the organization.” It has become a critical component of hiring, too. Bolten is a board member of Emerson Electric, and he described how industrial technology manufacturers rely on hiring talented young engineers, “and when they go to Georgia Tech and Purdue, they can’t recruit at all if they can’t show the sustainability report. If they can’t say, ‘Here’s what we’re doing; here’s how the technology you would be working on is a piece of helping to solve the climate crisis.’ That’s how they get the best employees.”

In 2019, Business Roundtable released a statement on the “purpose of a corporation,” signed by 181 CEOs, that redefined corporate responsibility away from the decades-old orthodoxy of shareholder primacy, arguing that companies must also invest in the interests of their customers, employees, suppliers, and communities. The statement was seen as a radical shift, a sudden sea change in corporate philosophy. “The reality is, this is a debate that’s been going on in C-suites and board rooms for many years now,” Bolten said on Thursday. “I view the statement as evolutionary, not revolutionary. The best CEOs were already headed in that direction.”

Gary Gensler, chair of the U.S. Securities and Exchange Commission (SEC), which in July proposed two rule changes that would prevent misleading claims and raise disclosure requirements for U.S. funds on their ESG qualifications, offered another imperative for forging ahead with ESG reform: if the United States does not take the lead in formalizing and adopting an agreed-upon set of standards, then American companies will likely find themselves forced to follow someone else’s rules. There is worldwide interest in the promise of ESG investing; the movement is global. “If we don’t finalize something,” Gensler said, then American companies doing business in Europe or Asia or South America “are probably going to have to comply with rules of the road based on other authorities and even other political systems.”

Williams professor of business administration George Serapheim

Screenshot by Harvard Magazine

During a lunchtime talk, Williams professor of business administration George Serapheim offered encouragement about the possibility—and, in the end, necessity—of establishing a system of measurements and information disclosures that would bring meaningful accountability to corporations’ ESG commitments. A co-leader of Harvard Business School’s Impact-Weighted Accounts Project and author of the just-published Purpose + Profits: How Business Can Lift Up the World, Serapheim took on various criticisms of ESG accounting, including one of the most thorny and persistent: that ESG impacts are too idiosyncratic or subjective to be measured accurately and consistently. “The response to that criticism,” Serapheim said, “is that our ability to measure those things really depends on our ability to start measuring those things.” In other words, it is necessary to start somewhere, and “over time, we will make improvements,” just as with any “minimum viable product.” He mentioned 1960s-era BMWs and early-model iPhones, which would look unrecognizable to consumers today. “Both of them have improved pretty dramatically because somebody started doing something,” he said. “I think it’s the same kind of idea.”

Furthermore, he added, failure to put a value on the destruction of forests and wetlands, the polluting of the oceans with plastic, “actually does put a value, and that value is zero.” Pointing to existing standards like the LEED (Leadership in Energy and Environmental Design) rating system for new green buildings, Serapheim said, “None of these standards are actually perfect. You can always criticize them. But we're better off because we have them, and because building a standard allows…for easier and wider adoption and for comparability of information…. So, if we are going to all row towards the same direction—companies, governments, investors—to solve some of the pressing problems that we have, we’d better have some accountability mechanism that provides alignment for all of us.”

The moral case for ESG came up most forcefully in discussions with activists, many of whom had experience advising and negotiating with corporations on social justice and environmental goals. Fred Krupp, president of the Environmental Defense Fund (and a recently elected Yale trustee), put the importance of ESG investment in stark terms: “We should understand the stakes, at least on the climate side,” he said. “There’s a monster out there. We can’t continue business as usual.” He pointed to the tens of millions flooded out of their homes during the past several weeks in Pakistan and the recent wildfires in the United States, Europe, and Australia. “We need to figure out what to do that is beyond an incremental change.”

The Harvard Kennedy School's Deval Patrick (left) moderated a discussion on "keeping ESG commitments" with civil rights attorney Sherrilyn Ifill and environmental activist Fred Krupp.

Screenshot by Harvard Magazine

Krupp was speaking with former Massachusetts governor Deval Patrick, who now co-directs the Kennedy School’s Center for Public Leadership, and Ifill, president and director-counsel emeritus of the NAACP’s Legal Defense Fund. The discussion ranged into deep questions, about whether capitalism can exist without democracy (“I’m not so sure,” Patrick said; “Commerce in an authoritarian regime, yes”) and the dark history embedded in corporate success (“We have all this innovation and we have the laws and the markets,” Ifill said, “but we also have violence and inequality and oppression, and that also has been part of the business model, and so you have to be honest about that”). When the question of maximizing profits came up, Patrick said, “This has been on my mind and heart for a long time—there’s this incredible emphasis on the next quarter, rather than the next generation.”

Ifill offered a brief meditation on the history of corporate citizenship and its obligation to democratic society. Tracing the very concept of corporate personhood to the equal protection clause of the Fourteenth Amendment, which ensured full citizenship to black Americans after the Civil War, she noted that corporations are “creatures of democracy,” incorporated by states’ governmental agencies, their power inextricably tied to the democratic infrastructure. “So, I don’t think that corporations have the right to be agnostic about democracy.” She also reminded business leaders: “There are all kinds of ways in which you could calculate how, for example, police violence against African Americans might affect your bottom line. Because it’s long term, and it’s costly. Oppression is costly; it isn’t free.”

“And not just to the oppressed,” Patrick added.

Ifill’s argument about citizenship and democracy echoed a point made earlier by Harvard Corporation member Kenneth Chenault, chairman and managing director of the venture capital firm General Catalyst and former CEO of American Express. “One of the important points for me when I was CEO was the recognition that corporations exist because society allows us to exist,” Chenault said. “We’re not entitled. And sometimes I think people forget that.” He was talking with Kenneth Frazier, the former CEO of Merck (now executive chair of its board), about the moral obligations for corporate executives in choosing whether or not to speak out on social issues. In 2017, Frazier made headlines by rebuking then-President Donald Trump and resigning from the president’s advisory council on manufacturing after Trump failed to forcefully condemn the white-nationalist march in Charlottesville, Virginia. “It feels a little like you can’t be in the middle anymore,” Frazier said. “On many of these issues”—not just racism but environmentalism and other social concerns—“your employees, your best employees, certainly your best younger employees, expect the company to take a position. And yet the reality of the world is, there is a counterattack out there, and you pay the price in the short run.”

A certain sense of inevitability struck Ifill too, as well as an awareness of the real limits of ESG (she, too, remembered the broken promises of companies that rushed into racial-justice commitments after George Floyd’s death)—but also the real possibilities. Noting the current “democratic crisis that we’re in,” she said, “There is no magic bullet. It turns out that there have to be contributions from all of the elements of democratic society. And that means people have to be able to vote and organize and, obviously, government has to function effectively. And when it doesn't function effectively, that’s deeply problematic. The business community has a role to play. The faith community has a role to play. The media has a role to play. It’s an ecosystem.” ESG was never meant to be a “panacea” on its own, she said. “We need government regulation.” But at the moment, “everybody’s kind of stuck, and we all have to get unstuck, and businesses are uniquely positioned to be unstuck more quickly than many of the other sectors. ESG is a way of beginning to have a dynamic conversation. That’s my plea today: that we not believe ESG is this kind of thin veneer, but that corporations take this opportunity to dig deep.”