In presenting the Faculty of Arts and Sciences’ annual report for the 2022-2023 academic year to colleagues at their November meeting, Dean Hopi Hoekstra faced the unusual problem of accounting for developments for which she bore no responsibility: she assumed her new office on August 1. Accordingly, after a graceful thank-you to predecessors and an upbeat framing of FAS’s mission, she handed the heavy lifting off to others.

The faculty. Nina Zipser, dean for faculty affairs and planning, provided an overview of the professoriate itself. The ladder faculty—tenured and tenure-track members—now numbers 730, up from 723 last year. Having risen from 657 members in 2004-2005 to 721 in 2008-2009, just as the financial crisis and Great Recession began, FAS’s ladder-faculty cohort has maintained essentially that level ever since. The peak year was 2017-2018, when Harvard Campaign proceeds were being put to work (739); the recent low point was 2021-2022, when the pandemic accelerated retirements and temporarily choked off searches and hiring (709). So, the story for the past decade and a half is essentially of a steady-state faculty.

Peering a bit more closely, data provided separately by Zipser’s office show the gradual change in FAS’s disciplinary composition. Of 657 ladder-faculty members in 2004-2005, 199 were in arts and humanities, 239 in social sciences, 154 in science, and 65 in what is now the separate engineering and applied sciences school. In the current year, those cohorts number 195 (arts and humanities), 238 (social sciences), 203 (science), and 94 (engineering and applied sciences); unsurprisingly, all of the net growth (plus a couple of positions) is in science-related fields.

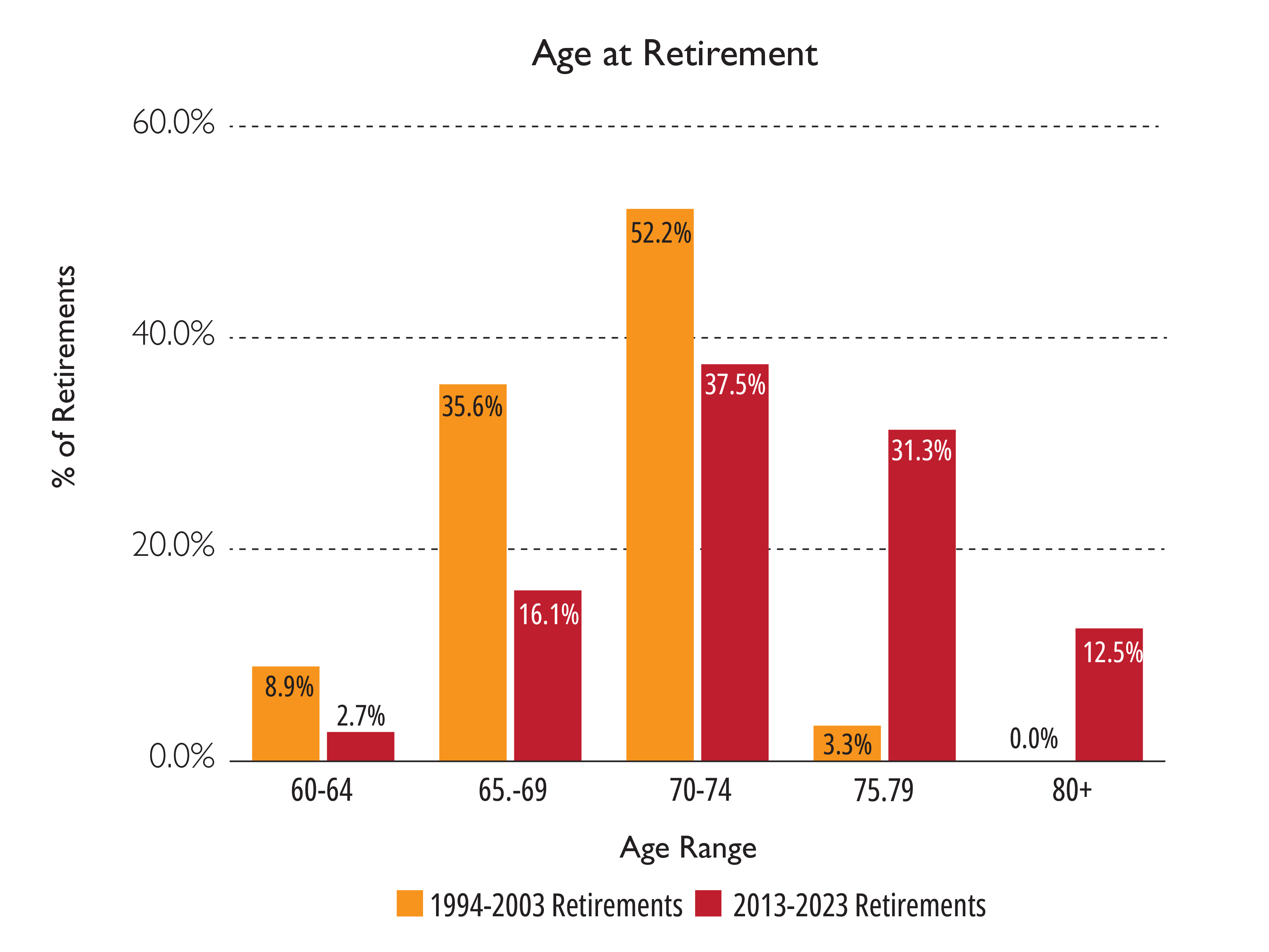

New this year was an overview of the faculty’s structure (tenured vs. tenure-track appointees) and its age profile and retirement pattern. Given that the tenure-track cohort is much more diverse in terms of gender and race/ethnicity characteristics than the tenured professors, it is significant to bear in mind that of the 730 ladder faculty members, 79 percent are tenured and just 21 percent are in the tenure-track ranks. Moreover, those tenured professors are extending their careers significantly. Looking back two decades, in the fall of 2003, about 18 percent of tenured faculty members were 65 years or older; in the current academic year, 37 percent of tenured faculty members were 65 years or older. From 1994 (when mandatory retirement was abolished) to 2003, the proportion of faculty members taking retirement at ages 65 to 69 was 35.6 percent; at 70 to 74, 52.2 percent; and at 75 to 79, 3.3 percent. In the most recent decade, from 2013 to 2023, the distribution of retirement ages had shifted sharply, with 16.1 percent aged 65 to 69, 37.5 percent aged 70 to 74, 31.3 percent aged 75 to 79, and 12.5 percent aged 80 years and up.

Zipser did not say so, but the data strongly suggest that on FAS’s present trajectory—given the heavily tenured composition of the faculty, and individual members’ significantly increased career longevity—realizing further, meaningful increases in FAS’s ladder-faculty diversity will be a generational effort, at least

FAS’s finances. Scott A. Jordan, dean of administration and finance, had good news to convey about 2021-2022 when he reported last year: increased endowment distributions and current-use giving, combined with reduced pandemic expenses, enabled FAS to realize an operating surplus of $99 million on a cash basis. Some $71.8 million of those funds were added to the dean’s unrestricted reserves, bringing them to 10 percent of operating expenses that year, a first for the FAS: a considerable cushion for future academic investments or unforeseen contingencies.

For the fiscal year ended June 30, 2023, he brought essentially the same glad tidings: FAS realized a cash operating surplus of $108 million, and a further $46 million were added to the dean’s unrestricted reserves, which now amount to $205 million, a sum that represents more than 13 percent of annual cash operating expenses. During the year, tuition revenues grew as the College cohort remained larger than normal (reflecting enrollments as students returned from pandemic leaves of absence or deferred admissions). Endowment distributions increased $44 million, to $833 million (51 percent of revenues), and current-use gifts rose nearly 33 percent, to $153 million (although apparently $35 million of that is attributable to a one-time or accelerated payment).

With the campus again in full operation, expenses naturally rose, too. The major drivers were salaries and wages, up more than 10 percent, reflecting the contractual 5 percent increase in union employees’ compensation, and 4.8 percent for nonunion employees, plus deferred filling of vacancies during and after the pandemic (the workforce grew 6.4 percent, to 2,837 full-time equivalents). Other notable expense increases reflect full use of buildings, higher energy costs, and the resumption of travel and entertainment. On a consolidated (including engineering and applied sciences), “modified GAAP” basis (reflecting adjustments from FAS’s cash accounting to University standards), total revenues for the year were $1.81 billion, up from $1.70 billion in fiscal 2022, and expenses were $1.74 billion, up from $1.61 billion in the prior fiscal year.

FAS spent a lot more on capital projects: $247 million in fiscal 2023, up from $174 million the year before. Major projects included Adams House renewal ($47 million) and the renovation and fitting up of 60 Oxford Street for the Harvard Quantum Initiative ($44 million).

Looking ahead, tuition revenue growth may abate as the undergraduate enrollment returns to normal, and one-time items (that large gift, reimbursement for COVID-19 expenses) are, well, one-time. But those are mostly distant clouds on the horizon. The endowment distribution, representing more than half of FAS’s revenues, will increase at least 4.5 percent this year. The unrestricted reserves give Dean Hoekstra running room of the sort FAS deans haven’t had since the first decade of this millennium.

For a more detailed account, see harvardmag.com/fas-report-23.