A powerful fourth-quarter rally led by fixed-income portfolios yielded a total return of 12.5 percent on endowment assets for the fiscal year ended June 30. The strong returns, after all investment expenses, raised the value of the endowment to a new peak of approximately $19.3 billion. That sum was up from $17.5 billion a year earlier, and slightly above the endowment value of $19.1 billion recorded at the end of fiscal year 2000. Modestly negative investment returns and rising distributions from the endowment to support Harvard's operations and programs (offset somewhat by capital gifts received) reduced the value of the endowment in each of the ensuing two years.

"Practically the whole return came in the fourth quarter, and a good portion of our value added came in the fourth quarter as well," said an obviously pleased Jack R. Meyer, M.B.A. '69, president of Harvard Management Company (HMC). HMC's in-house fund managers and the outside professionals who invest some of the assets had handily outperformed their benchmarks (the market results for each class of assets, measured by standard indexes) and peer institutions' endowments in the prior two fiscal years. Yet they couldn't take much pleasure from the absolute result: returns, respectively, of -2.7 percent and -0.5 percent.

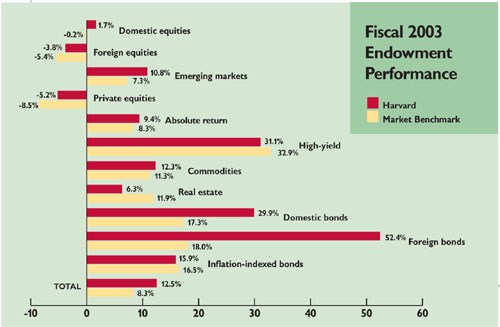

Fixed-income investments, about one-quarter of the endowment assets and a mainstay in fiscal year 2002, contributed even more in the year just past. "It's a pretty dramatic story," Meyer said. The foreign bond portfolio returned 52.4 percent, nearly triple the benchmark return. Domestic bond investments returned 29.9 percent, more than a dozen percentage points ahead of their index. In neither case, Meyer emphasized, were the results attained by extending the duration of bond holdings or assuming more credit riskthe sorts of bets fixed-income investors can make to try to time a market turn. Rather, he wrote in his annual explanation of results, "The outperformance was due to HMC's ability to capture perceived mispricings among a broad array of fixed-income instruments." Suggesting some of HMC's strategies and disciplines, he wrote, "These trades are subtle and complex, and tend to...perform particularly well when markets are unsettled."

In a good bond market and with rising hope for economic recovery, the high-yield portfolioa break-even performer in fiscal year 2002contributed strongly to the endowment's absolute gain in 2003, returning 31.1 percent, just shy of the benchmark. Meyer cited the emerging-market bond holdings within that portfolio for exceptional performance. He also noted that foreign bonds appreciated from changes in the currency market (the dollar weakened during the year).

Among other notable asset classes, commodities investments returned 12.3 percent, ahead of the benchmark, reflecting both gains in oil and gas investments and outperformance in timber assets. But real estate lagged its benchmark significantly, for the third year in a row. In the past, Meyer suggested timing differences were to blame. Now he thinks other factors are at work. The market benchmarks, he said, focus on "plain-vanilla, fully leased, high-credit-tenant properties"trophy office towers in central business districts, for example, which yield-oriented investors have snapped up in recent years as the equivalent of high-grade bonds. HMC, in contrast, invests in "opportunity funds," which focus on properties in need of new management and reinvestment, in pursuit of larger returns. "Over the longer term," Meyer wrote, "we expect the opportunity funds to prevail," but that has not been the case of late.

Overall, HMC's returns for the year exceeded the median return realized by a universe of 129 similar institutions' funds, each with assets of more than $1 billion, by 8.5 percentage points. (Yale and Princeton were no slouches, recording returns of 8.8 and 8 percent, respectively.) And HMC's performance bested its benchmarks by 4.2 percentage points: some $800 million compared to investing passively in a similar pool of assets.

|

During the three years ended June 30, when the Standard & Poor's 500 stock index declined an aggregate (not annual) 29.9 percent, foreign stocks by 34.8 percent, and venture investments by 43.4 percent, Harvard's endowment gained a cumulative 8.9 percent. In the same period, the average institutional fund and HMC's benchmark both declined by more than 6 percent. In that regard, Meyer wrote, "Experience teaches that a key to strong long-term investment performance lies in protecting assets during times of troubled markets," as HMC was clearly able to do "during a difficult three-year period."

Those results have more than arithmetical significance. During fiscal year 2003, distributions from the endowment to support academic operations, plus a special assessment for the costs of assembling properties in Allston, totaled about $850 millionaccounting for about one-third of all University revenue. Following the two years of negative returns, Harvard administrators began voicing concern about the erosion of the endowment's purchasing power. The recent gain moderates the magnitude of that erosion, of course, but does not eliminate it: as noted in Meyer's letter, adjusting for spending and the inflation indicators for higher education, "the endowment is still down roughly 11 percent" relative to its value at the end of fiscal year 2000. (See the related article on University finances.)

Cautioning, as ever, that HMC's "significant outperformance" throughout the past decade should not be counted on to persist, Meyer concluded his summary of the year by noting, "It's not that we expect to underperform. We just don't expect to have many years like fiscal 2003."