Douglas Melton was studying frog developmental biology in the 1990s. Then his young son developed type 1 diabetes, and he vowed to find a cure for the disease, which affects as many as 22 million people worldwide. He refocused his lab on the emerging science of embryonic stem cells, which can divide and differentiate to become any cell in the body, and by the early 2000s had outlined the road map to a treatment.

Melton would direct stem cells to become pancreatic beta cells, and transplant them into patients. “In type 1 diabetes,” the Xander University Professor explains, “you have a situation where patients have to prick their finger and measure the sugar in their blood, and then inject the right amount of insulin. The beta cell does both of those things. It measures blood sugars, and injects the right amount of insulin”—and does so better than any machine. Making beta cells by sleuthing out the right chemical combinations—delivered at just the right time, and in the correct concentrations—took 10 years, and was hailed in 2014 as a major scientific breakthrough in the quest for a diabetes treatment.

Isaac Kohlberg

Photograph by Justin Ide/HPAC

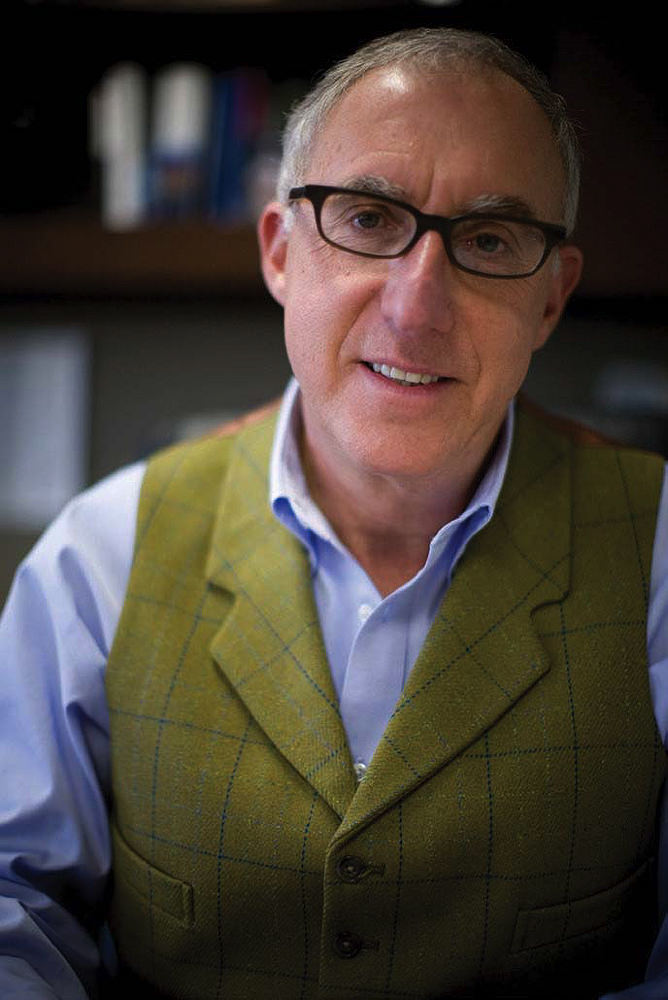

During the decade of work to advance his science, Harvard’s capacity to commercialize scientific discoveries also advanced significantly. In 2005, the University hired Isaac Kohlberg, an M.B.A. with prior experience managing technology commercialization at institutions in the United States and Israel, to lead its Office for Technology Development (OTD). Since his arrival, innovations reported annually to his office by Harvard researchers have risen 60 percent, and licensing revenue has more than doubled, to $54 million. Last year, the University entered into 51 new licensing agreements, including 21 licenses that went to startups it helped launch. Harvard is now ranked third, behind only Stanford and MIT, on Reuters’ list of the world’s most innovative universities, a metric that tracks inventions and citations.

Wallace professor of applied physics Federico Capasso, a prolific inventor who was a member of the committee that recommended that Kohlberg be hired, recalls that prior to that decision, “In order to file a patent, you needed to know who to talk to. It was like pulling teeth.” Since that time, Kohlberg, as senior associate provost and chief technology development officer, has assembled a team of more than 50 full-time staff that includes experts in business development, corporate alliances, and intellectual property—headquartered in the Smith Campus Center in Cambridge, with an effectively equal presence in the Longwood Medical Area. There is even an OTD team embedded in the Wyss Institute, a biomedical research organization that, over time, hopes to become self-sustaining by commercializing its inventions.

Melton, whose efforts to transform a scientific discovery into a therapy illustrate the challenges of commercialization (and why the expertise of OTD staff is valuable), says that a shift in Harvard’s attitude toward the private sector has been another critical ingredient in the University’s growing success in effecting this kind of “translation.” In the 1990s, there was “an unstated view that the commercial world should be separated from scholarly and intellectual activity,” he says, but now, “many people, myself included, believe that’s not just a false distinction, but the wrong distinction—that instead, one of the positions of the University should be to bring new knowledge to the benefit of people. It’s very hard to do that if you don’t use the word ‘commercialization.’”

The Startup

Melton knew that making his discovery a practical therapy would be challenging, because manufacturing beta cells on an industrial scale and transplanting them into patients would not be sufficient: those cells would also have to be protected from attack by the patients’ own immune systems—potentially requiring further scientific advances.

Nevertheless, recognizing the clear benefit—and value—of Melton’s discovery, OTD identified “an extremely effective” patent attorney to work with him and Vivian Berlin, OTD’s managing director of strategic partnering, to file patents on the discovery in countries around the world. Securing the intellectual property (IP) in this way is always the first step.

Berlin, “who worked very closely and intelligently with me,” then presented Melton with the three options he might pursue in his attempt to develop an approved human therapy. “One was to license it to companies that sell and make a lot of money on insulin, such as Sanofi, Lily, and Novo Nordisk.” A second was to “approach a large company without a presence in the diabetes market that wanted to enter it.” And the third was to “start a new biotech company, where you have more challenges around staffing and fundraising, but more control over whether the technology is advanced.”

In each scenario, Melton notes, OTD handles negotiations with both pharmaceutical companies and startups, “to try to get the most value for this IP.” Harvard’s intellectual-property policy then governs how royalties and other licensing revenue from a discovery will be divided, after assessing 15 percent off the top as an administrative fee. Of the remainder, 35 percent goes to the creator(s) as a personal share, and 15 percent as a research share. Another 15 percent flows to the creator’s department or center, 20 percent to the creator’s school, and 15 percent to the president’s office for allocation to institutional priorities. Because the funds that flow to department chairs, deans, and the president are discretionary (there are no constraints on their use), they are particularly valuable to the University.

Berlin arranged meetings with all the interested parties, and took notes as Melton weighed the merits of each approach. His eventual decision to launch a startup (with expert help and support from OTD) was driven in part by a conviction that this was the best way to ensure that a therapy would be commercialized quickly for patients, including his son—and his daughter, who also developed type 1 diabetes.

Melton says Harvard did not press him to make an arrangement that would necessarily lead to the highest financial return, as the University could have (and as occurred, famously, at Rockefeller University, which licensed the discovery of leptin, a hormone that helps regulate body weight, to the highest bidder, over the protests of inventor Jeffrey Friedman). OTD “listens to the investigator,” says Melton—consistent with its mission: public impact above monetary reward.

Melton founded Semma Therapeutics three years ago with $44 million in a first round of funding. OTD worked with venture capitalists to launch the startup and license the IP. Harvard is listed as the owner of the patented technology, while Melton and contributing colleagues are listed as the inventors, the standard practice in the United States. Semma has since improved Melton’s original protocol, industrializing it to work at scale and under conditions where the cells could be implanted into human patients. The company is exploring the opportunity to test the cells in a human clinical trial, which could begin in a year or two. First the cells would be tested in patients taking immunosuppressant drugs. Then, in order to provide a therapy without the need for immunosuppression, the company will test an encapsulating device made of fine mesh that allows glucose and insulin to pass through, but bars immune cells that would attack the transplanted beta cells. If successful, this protocol would provide a functional cure, or long-term therapy, for type 1 and even some cases of type 2 diabetes.

Partnering with Industry

Commercialization via the approaches Melton considered for his diabetes discovery is just one of the tactics in OTD’s strategy for advancing research. Another major focus is alliances with corporate partners. Such relationships advance innovation by generating research and development funding, while facilitating collaboration among the best researchers in the field, whether in academia or industry. They also enable sharing of resources such as data, research materials, or special facilities, Kohlberg points out. Typically, these partnerships are focused on real-world problems—something that researchers and students alike, at all levels, increasingly find appealing. Although the dollar amount of research funding from Harvard’s corporate partnerships is comparable to that from licensing (more than $50 million apiece in fiscal year 2018), there is one big difference: in corporate partnerships, all the income supports researchers in their work.

Some of the research agreements focus on collaboration with a single lab. Others are broader; a 2016 alliance with a group of Tata companies is providing $8.4 million over six years to researchers throughout Harvard working in areas of strategic interest to that multinational. A project in the labs of Charles River professor of engineering and applied science Robert Wood and Loeb associate professor of engineering and applied science Conor Walsh, for example, is looking at the role of robotics and wearable technologies in the factory of the future. Kohlberg’s team knows who is doing relevant research, helps the for-profit entity select the project it will fund, and drafts an agreement. For the companies, the incentive is an option to license the resulting IP, in order to develop it further toward a product or service.

To ensure that these agreements don’t compromise academic integrity, Kohlberg adds, the University has developed principles and policies to avoid conflicts of interest, to make certain that all research is faculty-initiated, and to ensure that there is no limit on publication. Research agreements therefore offer no guaranteed results to sponsors, include limits on duration and IP rights, and reserve the rights of researchers at Harvard and elsewhere to use any resulting discoveries for educational and not-for-profit research purposes.

Arlene Sharpe

Photograph by Jim Harrison

Fabyan professor of comparative pathology Arlene Sharpe, chair of Harvard Medical School’s new department of immunology, has collaborated through such agreements with a half-dozen pharmaceutical companies during the past five years as she works to find ways to trigger the immune system to recognize and attack cancers. She has thrived on the interaction with industry colleagues: “I feel incredibly fortunate to have had the collaborations I’ve had as a result of these alliances.” Currently, she is working with Channing professor of medicine Dennis Kasper, also an immunologist, to study the influence of the gut microbiome on the immune system. A venture-capital firm is providing $4.5 million to fund the research, and has first rights to acquire any resulting discovery—potentially leading to a startup that develops new therapies. “Harvard is fortunate to have the savvy people we do [in OTD],” says Sharpe.

Accelerators and an Entrepreneurial Ecosystem

Beyond licensing agreements and corporate partnerships, OTD has another tool at hand: internal “bridge” funding for research through “accelerator” programs. “The big challenge that any university has in advancing innovation,” Kohlberg explains, “is what we call ‘the valley of death.’” Many promising laboratory discoveries are not mature enough to interest investors or a company. OTD bridges that gap with two accelerators, one in the life sciences (funded by the Blavatnik Family Foundation in 2013), and a smaller fund in physical science and engineering, funded by the University itself. A volunteer advisory committee of venture capitalists, faculty, entrepreneurs and executives decides how to allocate the funds, while OTD does due diligence with professors’ proposals in advance to make sure that “there is a clear road map and trajectory” toward a marketable discovery.

“Accelerator funding is always quite helpful because it allows you to focus on de-risking the technology,” explains Wyss professor of biologically inspired engineering Jennifer Lewis, whose lab has benefited from both the biomedical and the science and engineering accelerators. Currently at work on development of an artificial organ (see “Building Toward a Kidney,” January-February 2017, page 37), Lewis says that among the reasons she decided to come to Harvard in 2013 was “this idea that at the end of the scientific discovery process, there was an enabling path for translation…allowing the impact of our work to be much bigger.”

In the past five years, OTD has helped faculty members start more than 70 companies and raise more than $1.5 billion in equity financing.

While the OTD measures its success in terms of long-term impact on society, its financial impact is already evident—and particularly salient in an environment of constrained federal support for research. The fiscal 2018 commercialization revenue of $54 million, and the corporate research funding of $51 million, point to a new vision for advancing academic innovation that meshes well with the University’s aspirations for developing an enterprise research campus in Allston: in the past five years, OTD has helped faculty members start more than 70 companies and raise more than $1.5 billion in equity financing to commercialize Harvard-based discoveries.

Kohlberg says success in this kind of work turns on building relationships of trust. “We spend a lot of our time in the labs” with researchers, rather than in the OTD offices, “and we interact on a regular basis with chairs of departments, with deans, and with heads of research centers in a very close way.” The result is a single, integrated ecosystem—unique in higher education, he says—built to accelerate the pace at which discoveries can become technologies.