Harvard’s financial results for the fiscal year ended June 30, 2023, released in October, depict University operations fully back to normal after the pandemic. With on-campus enrollment at a still-elevated level as students returned from leaves or matriculated after deferring their arrival, operating revenues rose, but less than in fiscal 2022. With hiring to fill pandemic vacancies largely complete and growth in the workforce to support research and other activities, expenses increased more rapidly, reducing the operating surplus to $186 million from the eye-popping $406 million recorded in the prior year. Two milestones were achieved: revenues exceeded $6 billion for the first time, and Harvard’s leaders have now accomplished a full decade of Crimson black ink.

Harvard Management Company (HMC), which is responsible for investing the endowment assets, realized a net 2.9 percent rate of return, improving upon the negative 1.8 percent return in the prior year. After toting up distributions to the operating budget, gifts received, and other transfers, that yielded a year-end endowment value of $50.7 billion, down fractionally from $50.9 billion as of June 30, 2022.

In their tone-setting annual letter, the new financial-management team of Ritu Kalra, vice president for finance and chief financial officer, and Tim Barakett, treasurer, focused on the context in which the University operates (volatile financial markets, rising interest rates, the Supreme Court decision on affirmative action in admissions) and the issues on which its scholarship and teaching can make a difference (from climate change to artificial intelligence and quantum science). Throughout the report, references abound to the academic mission and Harvard’s efforts to make its research, teaching, and collections accessible.

Turning to matters strictly financial, Kalra and Barakett moved beyond some of the inherent cautions of the prior leadership, whose successful stewardship during much of the past decade did a great deal to restore Harvard’s strength after the severe damage incurred during the financial panic and Great Recession of 15 years ago. That said, they briskly “acknowledge the [new] financial challenges that lie in wait”—a suggestion that the operating paradigm for institutions like Harvard may be shifting.

Foremost among these factors may be a secular change in economic conditions: “On the heels of the most substantial interest rate tightening cycles since the 1970s, the cost of capital is anticipated to remain elevated”—possibly affecting future investment returns. That matters because endowment distributions totaled 37 percent of fiscal 2023 operating revenues (and market returns also affect donors’ philanthropic capacity: current-use gifts accounted for a further 8 percent). Although hailing the “capable navigation of complicated markets” by HMC, they observe that the 2.9 percent return on investments is well below Harvard’s long-term return target of 8 percent—assumed to be sufficient to support distributions while preserving the assets’ value against long-term inflation.

The year in brief. Operating revenues increased 5 percent, from $5.8 billion to $6.1 billion, driven by endowment distributions (up $125 million to $2.2 billion) and net student income (up $100 million, to $1.3 billion, reflecting continued elevated College enrollment; graduate students’ return to campus housing; and, especially, resumed strong growth in executive and continuing education, rising 12 percent to a record $544 million).

Expenses totaled $5.9 billion— up nearly a half-billion dollars from $5.4 billion in fiscal 2022: 9 percent. Salaries and wages rose $215 million (nearly 10 percent), to $2.4 billion. About half that increase is attributable to merit increases and other adjustments for nonunionized employees, and to negotiated contracts for unionized staff. The rest reflects growth in the workforce—principally from filling positions that remained vacant at the end of fiscal 2022 when hiring was particularly difficult. Positions have also been added to support research, information technology, and growing operations like executive and continuing education. Other expense categories growing notably reflected the resumption of full University operations and increased in-person use of facilities. Space costs, for example, rose $40 million (11 percent), as more people worked more hours on campus, and as energy prices increased, and travel expenses more than doubled, to $93 million, as more people got on more airplanes and paid higher fares.

The endowment. Fiscal 2023 was the sort of year that vexed managers of large, diversified endowments like Harvard’s. As common market indexes, like the Standard & Poor’s 500 and NASDAQ (up 19.6 percent and 26.1 percent), soared mostly in the second half of the fiscal year, and mostly on the gains of a very few large-capitalization technology stocks, permanent endowments lagged. The more sophisticated their strategies and the more highly diversified their assets, the larger the gap. Smaller endowments and foundations, which tend to invest principally in publicly traded securities, appear to have earned 9 percent to 10 percent returns on average during the year (stocks up, bonds down). But somewhat larger institutions appear to have realized rates of return averaging 6 percent to 7 percent, reflecting the underperformance of private equity holdings—and the larger the endowment, the greater the penalty.

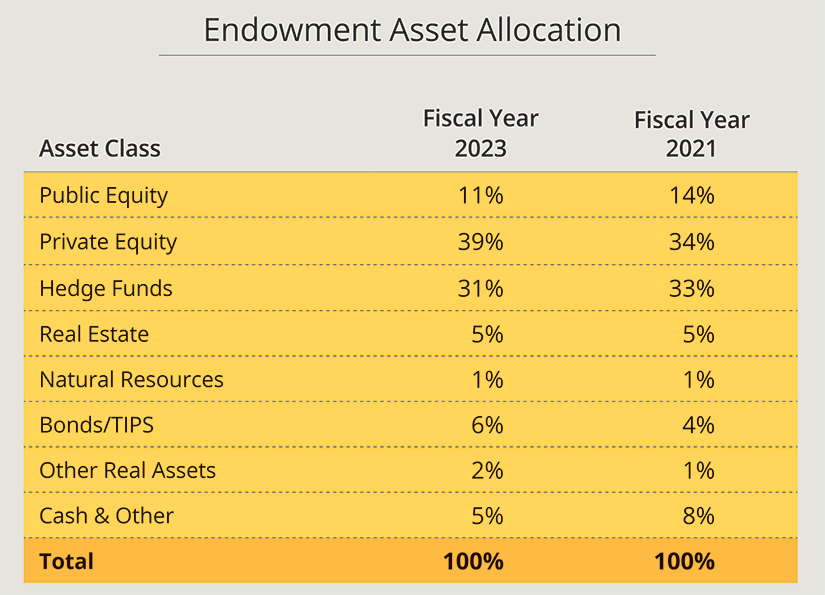

HMC’s realized investment return, 2.9 percent, was at the upper middle of the pack, which ranged from MIT’s negative 2.9 percent, Princeton’s negative 1.7 percent, and Duke’s negative 1 percent to those in the black: the University of Pennsylvania (1.3 percent), Dartmouth (1.6 percent), Yale (1.8 percent), the University of Virginia (2 percent), and Stanford (4.4 percent). The story of the year, in brief, was private equity: some 39 percent of HMC’s investments are in this asset category, and as CEO N.P. Narvekar reported in his fiscal 2023 letter, returns “proved to be only slightly positive in private equity and mildly negative in venture capital/growth,” in line with his prediction during the prior year.

Looking ahead, he pointed to asset allocation as an HMC strength, citing past decisions to deemphasize now-troubled asset categories such as commercial real estate. Another source of stronger future returns may lie in the recent increase in tolerance for investment risk, negotiated with the University, that underlies the planned increase in private equity holdings during the past couple of years.

In prospect. The University is financially sound and in an enviable position to pursue its intellectual ambitions. But those favorable conditions persist only so long as the community both remembers how hard-won the institution’s current financial strength was and applies those resources prudently in an environment of rapid economic change and great political uncertainty. An operating surplus of $186 million is not chump change—but after a year when expenses rose 9 percent, a 3 percent operating margin isn’t that much of a cushion.

Harvard’s list of expensive wants is long, from increased financial aid to investments in scientific research and pending capital projects ranging from completion of House renewal to significant building needs for the design, education, and public health schools’ facilities. And no one has begun to tote up the costs of retrofitting the campus to meet sustainability goals. So there is plenty to do now and (whetting fundraisers’ appetites) in the future.

In that context, Kalra and Barakett warned that “the costs of running a world-class university…continue to increase,” as research in all disciplines becomes more computational and data-driven, and as scientific discovery in particular demands ever more sophisticated, expensive apparatus, facilities, and skilled staff. The fiscal 2023 growth in expenses was twice the rate of increase in revenues, and “This is not sustainable”—especially given constraints on such traditional funding sources such as tuition after financial aid, and federal support for research. Hence a continuing focus on “prioritizing activities which most consequentially contribute to our mission” and on using “our financial, physical, and technological resources more effectively.”

Read a complete report (including information on capital spending, gifts, the balance sheet, and further details on the endowment) at harvardmag.com/endow-results-23.