Harvard’s annual financial report for the fiscal year ended June 30, 2021, published today, shows much more favorable results than might have been expected when the University was forced to send students home in March 2020, beginning more than a year of remote instruction. The report also discloses extraordinary growth in the endowment. These twin developments suggest a strong Harvard emerging from the pandemic even stronger: better positioned to educate and conduct research in the future, depending on how it chooses to allocate its immense human and financial resources. Among the highlights:

• The endowment’s value soared to $53.2 billion as of this past June 30—an increase of $11.3 billion (27 percent) from $41.9 billion a year earlier.

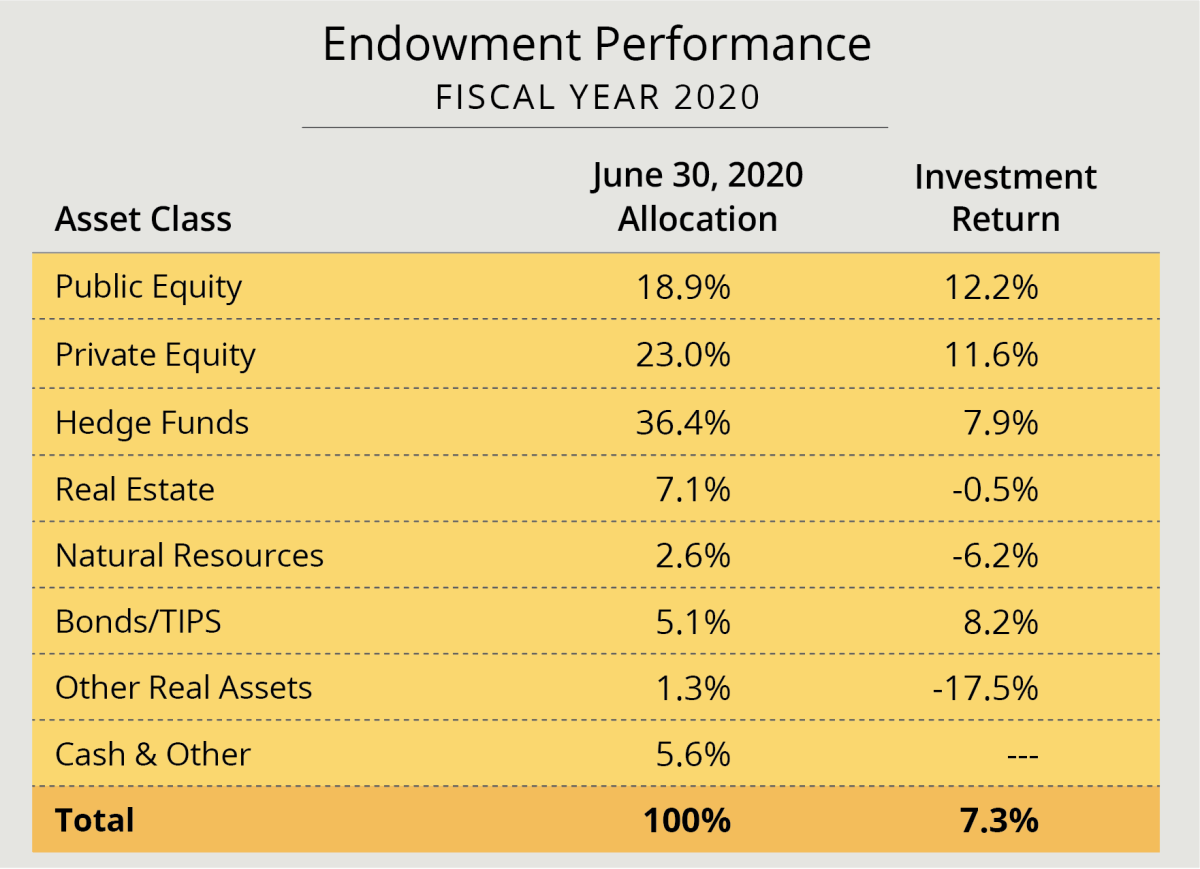

• Harvard Management Company (HMC) recorded a 33.6 percent investment return on endowment assets during fiscal 2021, up from 7.3 percent in the prior year. That was the highest return recorded since the 43.6 percent achieved in fiscal 1983 (during a period of declining interest rates and recovery from a recession) and 32.2 percent in fiscal 2000 (during the dot.com boom).

• Endowment investment returns for the year—net realized and unrealized gains (after investment fees and expenses)—totaled a staggering $12.8 billion. That sum eclipsed the traumatic $11-billion loss recorded in fiscal 2009, during the financial crisis and Great Recession, and handily outpaced the $9.6 billion realized from all sources and for all uses by The Harvard Campaign, which concluded in June 2018. (Total investment returns—on the endowment, general operating funds, and other assets, were $14.8 billion.)

• The University ended the fiscal year with a $283-million operating surplus, much better than the prediction from last spring that despite reduced enrollment and a second consecutive year of declining revenues, Harvard would be able to break even. (In fiscal 2020, the University reported a $10-million operating deficit, including one-time costs and accounting charges; those expenses aside, Harvard would have shown a surplus of about $240 million that year—thus coming through the pandemic, and two consecutive years of reduced revenues, with operating surpluses totaling more than a half-billion dollars. And it managed those surpluses without layoffs or suspending the compensation of idled employees or contracted workers.)

The Crimson in the Black

In May 2020, executive vice president Katie Lapp forecast a net shortfall in anticipated revenue of $415 million for the fiscal year ending that June 30, and of as much as $750 million in fiscal 2021, beginning that July 1. That dire scenario, for an institution with $5.5 billion in fiscal 2019 revenues, and a steady growth rate of 5 percent, translated into the need for severe belt-tightening across the enterprise.

Harvard’s revenues did decline about 3 percent, to somewhat less than $5.4 billion, in fiscal 2020—a shortfall of about $270 million with anticipated growth taken into account: a wake-up call, but not the $415-million gap of Lapp’s forecast. Given that the reversal took place late in the year, if that sum were annualized, Harvard might have anticipated a gap approaching $1 billion in fiscal 2021, almost one-fifth of prior revenues.

Again, the fiscal gods looked very kindly on Harvard. Fiscal 2021 revenues decreased again, by about $125 million (a bit more than 2 percent), to slightly under $5.3 billion. That does produce a shortfall compared to perhaps $6 billion in revenue anticipated for the year, prepandemic (assuming 5 percent annual growth in the past two years). But expenses decreased by more than $400 million (nearly 8 percent), to just under $5 billion. The result, a financial officer’s delight, was a surplus of $283 million.

What went right for Harvard?

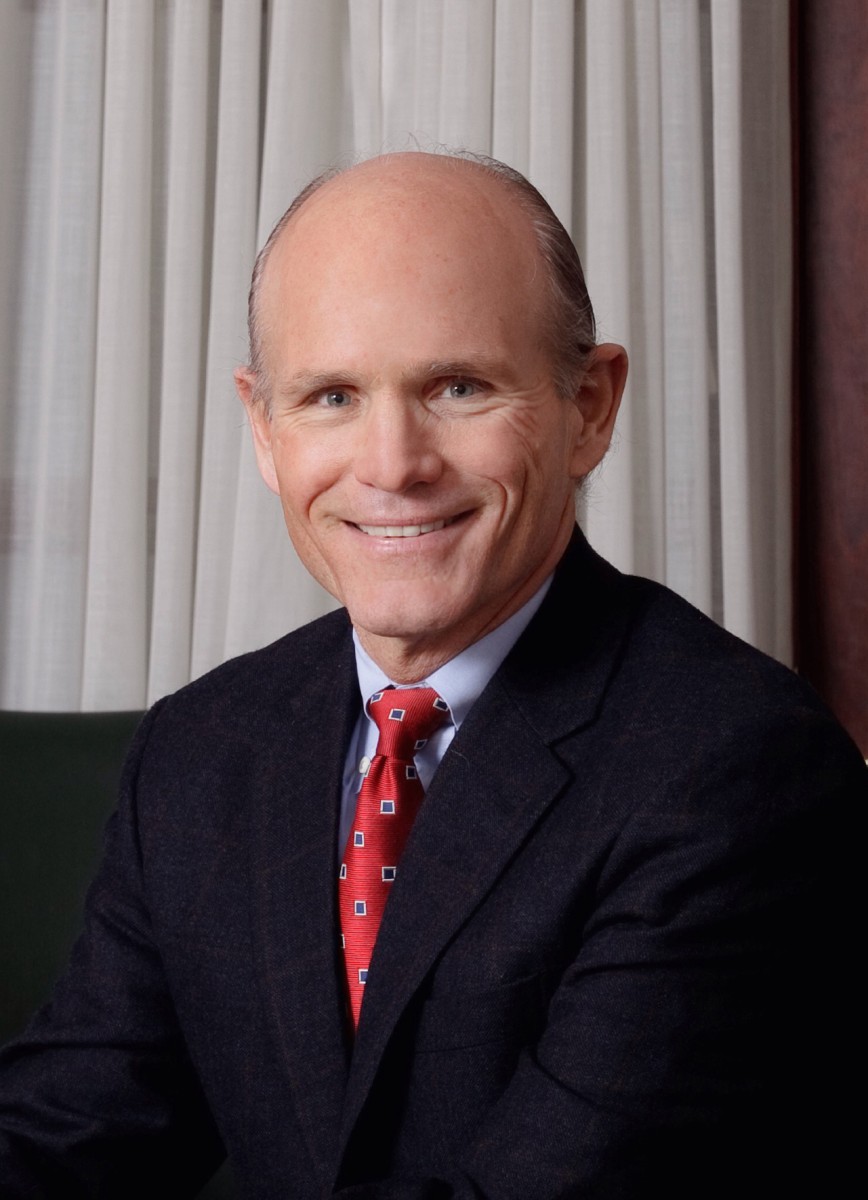

Thomas J. Hollister, CFO

Paige Brown, Courtesy Tufts Medical Center

In their annual report letter summarizing the year, Thomas J. Hollister, vice president for finance and CFO, and Paul J. Finnegan, treasurer, observed that “Harvard’s finances ended the year in a dramatically improved position” compared to initial budget assumptions, as the University “community rallied in a shared and purposeful effort to reduce expenses commensurate with the losses in revenues.” Both, in aggregate, declined 5 percent from fiscal 2019 through fiscal 2021. The surplus, they noted, came despite $83 million in spending this year on safety and health measures (testing and tracing, personal protective equipment, reconfiguration of classrooms and labs, and digital technologies for remote teaching and other ways of doing academic work). And despite initial plans to lay off idled employees and contract workers, the 2,800 people affected instead retained full pay and benefits through 2020, and 70 percent of compensation this calendar year, at a cost of $60 million.

Revenue. The net decrease in revenue, 5 percent during the two-year period, is perhaps half what University administrators feared.

Total student income, unsurprisingly, decreased nearly $200 million in fiscal 2021 (17 percent) to $888 million. Hundreds of admitted undergraduates deferred their matriculation, and hundreds of upperclassmen and -women took leaves; and given the reduced instruction in residence, room and board fees plummeted. Graduate and professional attendance was reduced, too (in part because international students could not easily travel to the United States). In toto, tuition in degree programs declined by $55 million, and room and board revenue declined 58 percent to $69 million.

From fiscal 2019 through 2021, student income has fallen nearly a third of a billion dollars. In the near term, the loss of tuition revenue is painful for the schools, because those are unrestricted funds, available for deans’ highest priorities; this poses a particularly acute problem for the Faculty of Arts and Sciences. On the other hand, those losses can be seen as timing differences: they should reverse in the current year, as the College, for example, enrolls its largest cohort since the end of World War II, and graduate students who deferred admission or took leaves swell their schools’ rolls, too. (Even with per-student scholarship and financial aid increased, the reduced enrollment translated into an overall decline in total scholarships and other student awards of about $50 million, to $597 million, during fiscal 2021.)

Net executive and continuing education revenue declined to $378 million (down about 8 percent from $410 million in fiscal 2020). But this is an example of relatively good news: executive and continuing education revenue declined about $90 million (18 percent) in fiscal 2020, hitting Harvard Business School (HBS) and the Faculty of Arts and Sciences’ Division of Continuing Education particularly hard. The fiscal 2021 result was much better than feared, reflecting schools’ pivot to online offerings, and customers’ interest in maximizing their skills during the pandemic. (On the other hand, this was a $500-million business in fiscal 2019, growing at 9 to 10 percent a year, so the gap between current operations and an anticipated $600 million in revenue for fiscal 2021 looms large. For HBS, with four buildings in Allston dedicated to in-person executive education, online offerings make up only partially for pressures on a huge program.)

Sponsored support for research held up remarkably well, increasing 1 percent to $927 million. Federal funding (67 percent of the total), increased about 1 percent, while funding from corporations, foundations, and other non-federal sponsors held essentially flat.

The true heroes for Harvard in fiscal 2021 were supportive donors, past and present. The endowment distribution for operations increased about 2 percent, to just over $2 billion. And gifts for current use surged $63 million (13 percent) to $541 million (although some of this reflects a swing in payments to Harvard from its affiliated hospitals, which were deferred in 2020 and resumed in the most recent year).

There were also unpredicted pockets of strength in the grab-all other category. Publication and royalty income increased to more than a quarter-billion dollars, up about 6 percent. Royalties on intellectual property soared to $107 million, up from $62 million in fiscal 2020. These growing sectors held total other revenue at nearly $700 million, down minimally from fiscal 2020, even as income from rentals and parking shrank (to the direct detriment of the Campus Services organization).

The aggregate result is a financial profile for Harvard much changed from prior years. As shares of revenue:

• student income decreased from 22 percent in fiscal 2019 to 17 percent last year and in 2021;

• sponsored research, 17 percent in the earlier two years, has now ticked up to 18 percent;

• current-use giving rose from 8 percent, to 9 percent, to 10 percent now;

• the endowment distribution rose from 35 percent of revenue, to 37 percent, to 39 percent now; and

• all other sources rose from 18 percent, to 20 percent, before decreasing to 16 percent in fiscal 2021.

That means that 49 percent of University revenue is from current-use gifts and the endowment (which can be very volatile, depending on market conditions and Harvard’s investment strategy). As discussed below, the endowment’s performance was historically strong in fiscal 2021, but Harvard’s increasing dependence upon it makes setting the appropriate guardrails and executing the investment strategy ever more important. And although donors’ current giving surpassed expectations at the worst moments early in the pandemic, their largess is not inexhaustible.

At the level of individual schools, the picture is even more sharply drawn. In a year with tuition and fee income depressed, the Faculty of Arts and Sciences derived 54 percent of revenue from the endowment (up from 50 percent in fiscal 2019), and 9 percent from current-use gifts (up from 7 percent). That makes it much more vulnerable to the inherent volatility in investment returns than, say, the Business School (23 percent of revenue from endowment distributions in fiscal 2021)—and to donors’ financial condition. Some of the current-use funds received this year may reflect donors’ willingness to accelerate payment of past pledges: the financial statements show that pledges for such gifts University-wide declined from $624 million at the end of fiscal 2020 to $534 million this past June 30, continuing a sharp two-year trend. (Gifts for endowment, discussed below, seem to have held up relatively well; the pledge balance declined only modestly, to about $1.3 billion.)

Expenses. The large decrease in expenses during fiscal 2021—perhaps surprising, given Harvard’s elite reputation, with salaries and facilities to match—requires some explanation. In fiscal 2020, the University booked a $71-million accrual for a voluntary early retirement incentive, and a charge to reflect the reduced value of the below-grade structure on which the Allston science and engineering complex—now completed and occupied but smaller than initially intended—was built. That charge, probably on the order of $160 million or so, and the retirement costs, converted what would have been an operating surplus into a reported $10 million of red ink. Happily for the fiscal 2021 accounts, those expenses do not recur (the “other expenses” category, for example, records “fixed-asset impairments” of $21 million in fiscal 2021, down from $182 million in the prior year), contributing to the more than $400-million decline in reported expenses this year.

Still, give credit where credit is due. Excluding the 2020 retirement program, compensation expenses—more than half of Harvard’s costs annually—decreased 1 percent, reflecting those retirements (and, of course, the salary freeze for faculty and nonunion staff, and the effects of reduced hiring). Reported salaries and wages thus decreased about $58 million, to about $2.1 billion. Benefits also decreased, to a reported $578 million, down from $621 million.

The major savings, of course, came from reducing the in-residence operations of a residential teaching and research institution. Travel costs declined $69 million, to essentially zero. Space and occupancy costs declined $47 million as utilities and other expenses diminished. And purchases of supplies and equipment and miscellaneous services declined $59 million.

One significant category of expense, happily, rose. Depreciation expense increased by $34 million, to $410 million, as the huge Allston science and engineering complex (featured on the report cover, shown above, along with masked members of the community and a virus-testing vial) began operating. The value of the research facilities recorded among Harvard’s fixed assets increased from $2.5 billion to $3.4 billion during the year.

Balance sheet and capital items. The University maintained a relatively large cash position, some $1.5 billion, outside its General Investment Account—down only marginally from the elevated $1.6 billion reported at the end of fiscal 2020, among heightened pandemic uncertainties. Debt outstanding decreased from $5.7 billion to $5.5 billion, reflecting bond maturities and fixed-rate bonds paid down. Interest expense on debt remained essentially level at about $180 million, and Harvard maintained its Aaa/AAA credit ratings.

Finally, capital spending continued to decline, to $410 million in fiscal 2021, down from $627 million in 2020 and sums nearing $1 billion annually in prior years. Major projects have been completed (the Allston science complex, the Soldiers Field Park housing renovation, the Divinity School’s Swartz Hall, the Houghton Library renovation), or nearly so (the Law School’s Lewis Hall expansion and renovation), and are otherwise being stretched out (Adams House renewal) or deferred (the Eliot-Kirkland House renewals). The financial footnote on facilities shows “construction in progress” declining a stunning $1 billion during fiscal 2021: a vivid reminder of how much work had been under way, and how dramatically the capital budget has been shrunk.

All in all, Harvard has steered through the pandemic with its academic programs and fiscal resources intact—especially so because of that other balance-sheet item, the endowment.

An Historic Endowment Year

Expectations for exceptionally robust endowment returns reflected financial-market reactions to the federal government’s emergency spending and the Federal Reserve Board’s aggressive measures to reduce interest rates—both in response to the crisis created by the pandemic in early 2020. Those trillions of dollars of support for unemployed workers and beleaguered businesses, and the resulting economic recovery, led to 40-plus percentage-point gains in U.S. stock indexes during the fiscal year ended this past June 30. Those conditions also prompted a deluge of initial public offerings by new companies at eye-popping valuations (rewarding the venture-capital and private-equity funds that had underwritten them: investment managers to whom large endowments often allocate sizable shares of their assets).

The Wilshire Trust Universe Comparison Service, a standard analysis of institutional investments, reported the best overall results in 35 years, with median returns of more than 33 percent for large foundations and endowments (assets of $500 million and above in its data, a very far cry from Harvard’s endowment). That was nearly 10 times the median return of 3.4 percent for fiscal 2020. But there is a great deal of variation around the lofty 2021 median: some very large institutional investors reported returns in the range of 20 to 30 percent, while some universities with sophisticated, diverse endowments measured in the billions of dollars (still much smaller than Harvard’s) realized even higher returns, reflecting their outsized venture-capital and related holdings. HMC’s reported results are thus right at the Wiltshire median return during an exceptional year.

The endowment’s value. HMC, which invests the University’s endowment and other financial assets, revealed that during fiscal 2021, the endowment’s value increased 27 percent, to $53.2 billion; during fiscal 2020, when the pandemic began and the economic outlook remained uncertain, its value had appreciated 2.4 percent, to $41.9 billion. Thus, in absolute terms, the endowment’s value increased a breathtaking $11.3 billion during the fiscal year just ended. (Harvard’s calculation includes pledges for future donations: $1.3 billion as of this past June 30. Some other institutions, such as MIT, exclude pledges from their reported endowment balances.)

It is the growth in real, inflation-adjusted value over time that determines how much the University can increase spending on its academic mission: hiring faculty members, providing financial aid, running libraries and laboratories, etc. Even in an environment of somewhat elevated inflation, HMC’s managers had no trouble realizing enormous gains in real endowment value during fiscal 2021.

The change in the value of the endowment reflects the intersection of:

Appreciation. HMC’s money managers—primarily external investment firms—achieved an aggregate 33.6 percent investment return (realized and unrealized; after all expenses), producing an increase in value of $12.8 billion.

Distributions. The endowment is a permanent source of capital, investment earnings from which funds can be distributed to pay for University operations. Such distributions reduce the endowment’s value. In fiscal 2021 (as discussed above), those distributions, slightly more than $2.0 billion, accounted for 39 percent of the funds used to operate Harvard—by far the largest source of revenue and likely a record high as a share of the budget. The rate of distribution to schools on each unit of the endowment they own, set by the Harvard Corporation, was held flat during fiscal 2021, a conservative decision driven by the uncertainties prevailing when budgets for the academic year were made final in the late spring of 2020. The increased absolute distribution in 2021 from slightly less than $2.0 billion in the prior year reflects growth in the number of units each Harvard entity owns as it receives endowment gifts or transfers funds into its endowment accounts.

Gifts. Finally, the value of the endowment is augmented by capital gifts received: fulfillment of pledges made during prior years (for example, from The Harvard Campaign), and other capital funds given during the current year. Gifts received for endowment during fiscal 2021 totaled slightly less than $0.5 billion, essentially unchanged from the prior year’s total.

Thus, the result for a record-setting year (in rounded numbers) is:

• $41.9 billion beginning value as of July 1, 2020,

• plus $12.8 billion (fiscal 2021 realized and unrealized investment gains),

• minus $2.0 billion in operating distributions for the University budget (and $33 million in one-time or limited “decapitalization” distributions apart from the operating outlays, about level with the 2020 sum),

• plus $0.5 billion in gifts received for endowment,

• equals the endowment’s reported $53.2-billion value as of this past June 30.

For the record, some of the magazine’s earlier estimates of the endowment’s value, online and in print, were too conservative.

Harvard’s endowment in context. With the restructuring of HMC begun by CEO N.P. Narvekar in early 2017 essentially complete (see a detailed discussion here), the focus is now on executing the investment team’s strategy and assessing its performance over the course of economic and financial cycles. In the context of fiscal 2021 particularly, past performance, as they say, is no guarantee of future results.

N.P. Narvekar, CEO, Harvard Management Company

Photograph courtesy of Harvard Management Company

In Narvekar’s letter in the annual financial report, his calm, controlled personal demeanor is very much on display, as he introduced the outsized results in anodyne prose: “For the most recent fiscal year, which ended on June 30, 2021, the return on the Harvard endowment was 33.6% and the value stood at $53.2 billion.”

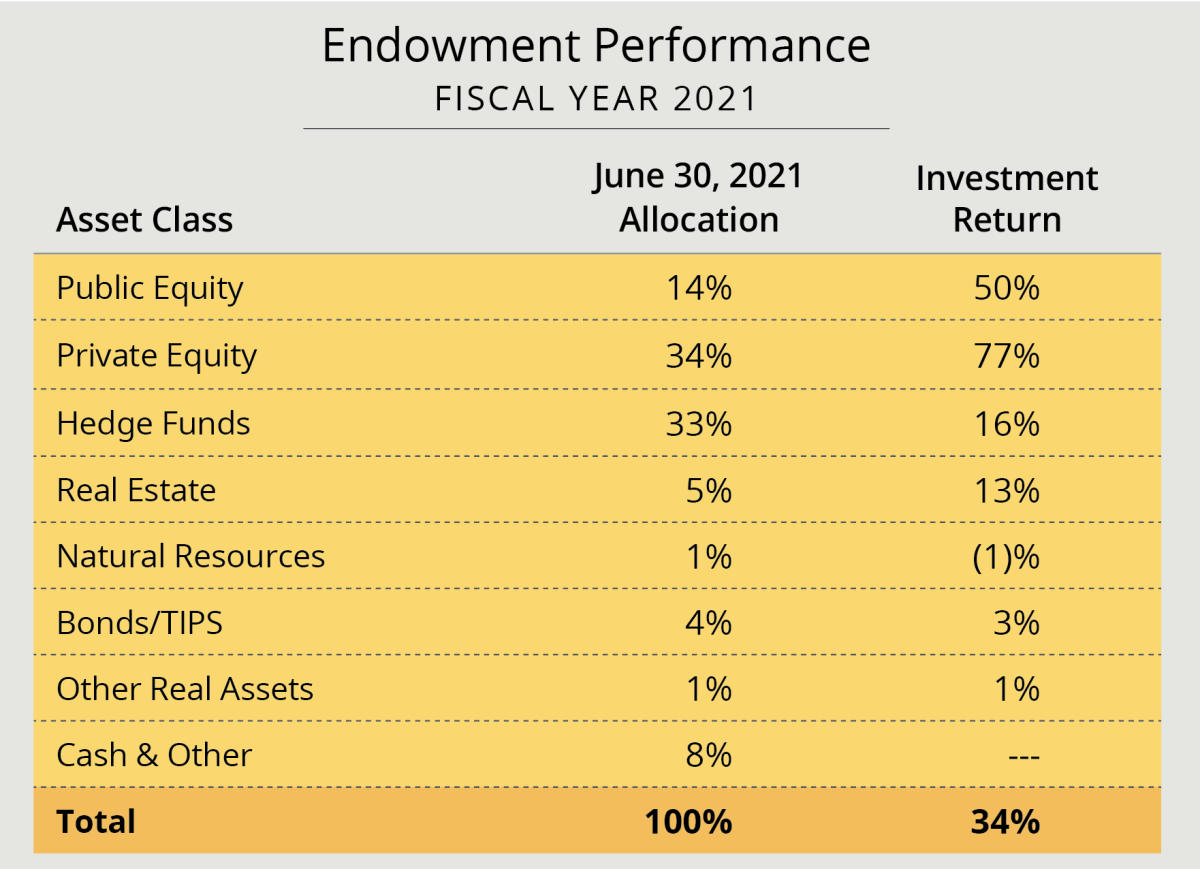

Those results were driven by extraordinary performance in equity investments. HMC’s managers achieved 50 percent returns on public equities (14 percent of HMC’s assets—and a significant measure of outperformance versus the market, since that total includes substantial foreign stockholdings, where returns lagged U.S. equities). Even better were the 77 percent returns on private equity (34 percent of assets, the largest single allocation). As the asset and performance data shown here reveal, HMC’s portfolio looks very different even from its fiscal 2020 profile.

The large shift toward private equity reflects, to some extent, Narvekar’s focused move in that direction since fiscal 2018 (with a related sharp reduction in the real-estate and natural-resources portfolios). But that is a multiyear, deliberate process; much of what drove the recent growth in private-equity holdings appears to be the sheer level of appreciation during the fiscal year.

Other changes in allocation—such as the sharp decrease in public equity, where HMC’s external managers continued a multiyear record of significantly outperforming market benchmarks—reflect a separate issue.

As Narvekar wrote, “For each of the last three fiscal years, asset allocation/risk level was a significant determinant of returns—the higher the risk taken, the higher the return generated.” In other words, it has paid investors to own equities. That very much continued to be the case in fiscal 2021, he continued, “with one major difference. During the previous three fiscal years, the impact was measured in a few percentage points.…By contrast, the impact of lower portfolio risk this past year was measured in tens of percentage points.” In other words, the more equity-oriented, and thus risky, a portfolio, the more extraordinary the absolute returns, and the wider the margin of outperformance relative to returns from other asset classes, such as real estate or fixed-income instruments.

This prompts two significant questions about HMC’s portfolio and performance. Why was it reducing its public-equity (stock) holdings, even as they provided robust absolute and relative returns? And why was it maintaining a large allocation to hedge funds, many of which are deliberately not linked or correlated to equities, and enlarging holdings of cash and other reserves that generated essentially no return?

The simple answer to both is that HMC’s client, the University, has prescribed a lower level of investment risk than some other institutions have embraced, reflecting its perceived financial and academic needs. As Narvekar put it in his letter:

Harvard should take an appropriate amount of risk, subject to some important constraints. The main constraint for any university is its ability to absorb a significant reduction (even if only temporary) in the value of the portfolio and the resulting reduction in distributions critical to the annual operating budget. Furthermore, since most of the highest risk assets are illiquid ones (such as venture capital funds) a major decline in market/portfolio will generally result in a reduction in portfolio liquidity, a potential issue for both HMC and Harvard.

Following the traumatic experience in the financial crisis and Great Recession—when the University’s net assets decreased $14 billion during fiscal 2009, it was forced to take on $2.5 billion in high-cost debt to have adequate cash, and Harvard’s revenue subsequently declined as the endowment distribution had to be cut— the Corporation set in place new financial controls and systems. It insisted on greater liquidity (mindful of the doubling of debt service), and the several HMC CEOs who directed the endowment during much of the decade held private equities to between 11 and 13 percent of the portfolio for several years (while making allocations to other illiquid categories such as natural resources and real estate).

During the restructuring he began in early calendar year 2017, as Narvekar summarized in his 2021 letter, HMC deemphasized natural-resources and real-estate exposures, in part to increase growth-oriented and venture-capital private-equity investments, driven by his team’s view of their relative appeal as investments. But at the same time, to operate within Harvard’s risk parameters, as the proportion of private-equity assets increased, HMC had to reduce public-equity exposure, and to increase its low-equity hedge-fund holdings (as a way to reduce liquidity risk).

The result? During the year just ended, Narvekar wrote, “Harvard enjoyed tremendous returns, but also experienced the opportunity cost of taking lower risk” (emphasis added). In other words, in the remarkable fiscal 2021, “a meaningfully higher level of portfolio risk would have increased HMC’s returns dramatically.” HMC achieved median returns for the year, but given the performance of its asset managers, would have achieved still higher returns if the University had had in place a policy that tolerated more risk in the investment portfolio: if assets were more concentrated in growth-oriented private-equity funds, venture capital, public equities, or other kinds of hedge funds.

Looking further back, HMC’s reported 77 percent return on private-equity investments, Narvekar noted, was actually constrained because the endowment was underinvested in specific venture-capital firms from 2009 to 2014, when HMC was proceeding very cautiously to recover from the prior financial crisis. Those firms, and the commitments they made in those years, resulted in stratospheric gains for their investors in the year just ended. (As one example, the University of Virginia Investment Management Company reported a 98.7 percent return on its private-equity holdings.)

Harvard’s closest peers in endowment investment management—Princeton, Stanford, and Yale—have not reported fiscal 2021 results as of this writing, but given the long-term, overweighted commitment to private equity and venture capital that several of them have pursued, it is probable that despite their large size, some of them may have realized returns well above that 33 percent median. As an interesting indicator, MIT’s results, just released, are bracing: a 55.5 percent rate of return, and 49.0 percent growth in the endowment’s value during fiscal 2021, to $27.4 billion. Even smaller, less diversified, more liquid endowments (some perhaps with public-equity weightings above Harvard’s) have thrived in this environment. Among the schools that have released results (often without detailed asset-allocation and performance data so far), Duke had a 55.9 percent return, Washington University 65 percent, Penn 41.1 percent, Brown a reported 50 percent-plus, and Virginia 49 percent. Applied to an endowment corpus of tens of billions of dollars, Narvekar’s “tens of percentage points” difference in investment returns, based on risk decisions, adds up to real money—and real resources for each institution’s future ability to hire faculty, equip their labs, upgrade facilities, develop teaching technology, and deliver financial aid. Updated October 15, 2021, 9:00 a.m.: Yale reported a 40.2 percent rate of return on investments, yielding $12.1 billion in investment gains and increasing the value of its endowment to $42.3 billion as of last June 30, up from $31.2 billion at the end of fiscal year 2020, a gain of $11.1 billion or 36 percent. Updated October 26, 2021, 9:30 p.m.: Stanford today reported results right in line with Yale’s performance—a 40.1 percent investment return on its merged pool, net of fees, bringing the endowment’s value as of last June 30 to $37.8 billion (up from $28.9 billion in the prior year, a gain of 31 percent) as of the end of its fiscal year (August 31). President Marc Tessier-Lavigne said that the university's trustees have approved spending $500 million beyond the usual endowment distribution to support education research, aid, and other activities consistent with Stanford’s long-range plan. Updated October 28, 2021, 5:00 P.M.: Princeton today reported a 46.9 percent investment return in fiscal 2021, raising the value of its endowment to $37.7 billion—up from $26.6 billion a year earlier. Princeton derives 66 percent of its operating income from endowment distributions, nearly twice the endowment’s contribution to Harvard revenue in a typical year. Princeton’s venture-capital returns were reportedly in triple digits, and private-equity returns 99 percent for the year.

What’s next. Looking ahead, Narvekar hones in on the question of risk. “How much portfolio risk can and should Harvard tolerate?” he wrote. “While this appears to be a simple question, the answer is less obvious.” In previous years, he has noted that HMC and the University were focusing on this subject. This year, he detailed the process further, describing a Risk Tolerance group led by Safra professor of economics Jeremy Stein and CFO Hollister that enabled “an extraordinarily thoughtful analysis and debate, integrating Harvard’s financial position, its need for budgetary stability, and its ability to handle more risk.” Given the completion of HMC’s restructuring and the reallocation of assets within the current risk allowance, he continued, “The level of portfolio risk is ultimately the most important and fundamental aspect of portfolio construction (reflected in asset/risk allocation) and a critical decision for the University.”

It may be that the exigencies of coping with the pandemic delayed decisions based on that analysis, but resolving these issues is probably the largest point of leverage for HMC’s future performance on Harvard’s behalf. With its personnel and strategies in place, HMC is prepared to carry out investment decisions appropriate to whatever level of risk its client can tolerate. Apparently, the working group’s recommendations are now before the Corporation as the pandemic crisis diminishes. Narvekar points toward a decision during this academic year.

Even if the Corporation decides that Harvard has emerged from this period in a strong financial position, a tolerance for more investment risk would not result in a further, overnight transformation of HMC’s portfolio. For one thing, committing funds to private-equity managers remains a multiyear process. For another, as Narvekar is at pains to note, investment valuations are at a very high level. “As experienced investors understand,” he wrote, “Harvard’s endowment will not produce 33.6 percent returns each year. Indeed, there will inevitably be negative years”—much as that 43.6 percent return in fiscal 1983 was followed by losses (a negative 3.8 percent return in 1984), and the 32.2 percent of fiscal 2000 by a negative 2.7 percent the next year. It is good to remember that those $12.8 billion of endowment investment gains recorded in fiscal 2021 are realized and unrealized: what the markets give, they often take away, as recent stock-market declines in the face of higher inflation and rising interest rates have shown.

For long-term investors (like the people charged with managing an endowment), he wrote, “What is more important is that our team, investment process/analytics, organizational structure, culture, and aligned incentives provide HMC with the framework for long-term success.”

The University’s Position

Harvard has emerged from the pandemic, which shuttered much of its residential education and research operations, in a much stronger position than after the 2008-2009 financial crisis and recession: net assets are up sharply; the endowment has now more than caught up with inflation (restoring its real value from the fiscal 2008 peak of $36.9 billion, and then some); distributions in support of academic operations have been maintained; debt is down; pension obligations are largely funded; and, after a decade of ceaseless construction and renovation, the physical plant is in far better condition.

In his letter introducing the fiscal 2021 financial report, President Lawrence S. Bacow, whose tenure has been sharply shaped by the pandemic, rightly points to the University’s investments in maintaining community members’ health, sustaining employment even of idled and contract workers, and, looking beyond “[t]hese necessary efforts directed inward” to the “extraordinary efforts directed outward.” Among these, he lists “working on the frontlines and saving lives in the ever-shifting landscapes of medicine and science, contributing to vaccination development and deployment, devising ways for learning and working to continue despite disruption, and addressing the profound racial, economic, and social inequities laid bare by the pandemic.”

Remarkably, as he observes, Harvard continues to “adjust to an unpredictable situation,” but emerges from the pandemic—thanks to “strong financial stewardship” (and the other-worldly endowment results)—“positioned…to accelerate progress.”

Harvard is, by reputation and in fact, a rich institution. It is also an expensive one to run. The recent operating surpluses, and an endowment with its past purchasing power more than restored, are a financial opportunity. The experience with disciplining expenses is, on balance, salutary (although continued restraint in faculty hiring, and salary suppression, are not a formula for long-term success). Remote work and remote or technologically enabled teaching suggest future savings on offices, classrooms, and travel—especially in a place like Boston, with its high-everything costs. So, this might be a moment, unimaginable in the spring of 2020, to think big about the good that Harvard research and teaching can do, addressing those “outward” priorities Bacow listed.

A year ago, deans were cautioned that future investment returns were expected to be modest at best, so they should build budgets on the assumption that endowment distributions would trend “sideways.” After the 2021 manna, future returns may well be subdued, or worse. But in the meantime, the endowment is unexpectedly worth $11.3 billion more than it was in June 2020. At Harvard’s distribution rate, if the gains do not evaporate, that could support more than an additional $500 million in annual revenue for academic operations. The University’s “presumptive guidance” (as the financial footnotes characterize it) relies on a formula that smooths out distributions, so school spending is not artificially inflated following years of elevated returns, nor decimated when rates of return decline sharply. For the current fiscal year, deans are working with a 2.5 percent increase in the distributions from each endowment unit their schools own.

Looking forward, the Corporation is now in a position to boost the funds made available for the academic mission gradually; continue to hold the reins tight while tuition and fee income rebounds and extraordinary pandemic costs abate; or consider something dramatic, like a one-time payout to jump-start high academic priorities from among those Bacow highlighted, or the new initiatives in climate research or quantum science. Clearly, opportunities abound.

[Updated October 14, 2021, 1:25 p.m. In the news announcement about its endowment results, MIT said:

Under the Institute’s usual endowment spending formula, designed to smooth the highs and lows of market returns over time and ensure stable funding for its education and research, deployment of last year’s unexpected gains to support MIT’s operations would be deferred significantly.

The 55.5 percent return on the investment pool containing MIT’s endowment over the past fiscal year enables the Institute to put these gains to use more quickly, while still maintaining appropriate balances to meet future needs. Accordingly, MIT plans to increase endowment payout by 30 percent starting in fiscal year 2023 (which begins on July 1, 2022), aiming to “accelerate the work the world needs right now and deepen the support our students need”….

Taking this step will provide an estimated $286 million in additional resources to support the work of the MIT community in the coming fiscal year. It will also set a new baseline for endowment support for the budget in following years.]

It is also a time to reflect on what the institution has learned from the financial crisis of 2008-2010, and its response in the years since. If the Corporation and the University’s leaders believe they have truly strengthened Harvard’s finances and management and put in place the proper endowment strategy and professionals, now could be the time to reset the risks they believe the institution can and ought to take, academically and financially.

For all its riches—in people, facilities, and financial assets—Harvard still competes with other elite institutions. In 2000, the University’s endowment was $19.2 billion. On the strength of a 41 percent return that year, Yale’s endowment reached $10.1 billion, narrowly edging the University of Texas system for second place—but still, about half the Crimson’s total. Twenty years later, Harvard and Yale retained their relative rankings, but Harvard—with a much larger student body, faculty, and physical plant—had an endowment valued at $41.9 billion, and Yale’s was $31.2 billion: about one-third larger than the Elis’. After the 2021 results are released, the Crimson margin over its nearest peers, with whom it vies for the best talent, may have shrunk further. Updated October 15, 2021, 9:00 a.m.: Given Yale’s 2021 results, the Harvard endowment is now about one-quarter larger.

This is, to be sure, a rarefied cohort, and the short-term bragging rights matter most to a handful of partisans of each alma mater. But over time, the resources available to support each institution’s mission do matter, so the risks they can tolerate to raise and sustain those resources count, as do the ways they choose to deploy them—especially in an era of research universities’ rising dependency on endowments to fund academic operations.

The Corporation and Harvard’s leaders have some weighty deliberations on their docket.

Read the University financial report here. Read a Harvard Gazette Q&A on Harvard’s finances and operations with executive vice president Katie Lapp and Tom Hollister here.